Investing.com — Here is your Pro Recap of the biggest analyst cuts you may have missed since yesterday: downgrades at ON Semiconductor, STMicroelectronics, Diodes, Lyft , UDR, and Sonic Automotive.

InvestingPro subscribers got this news first. Never miss another market-moving headline.

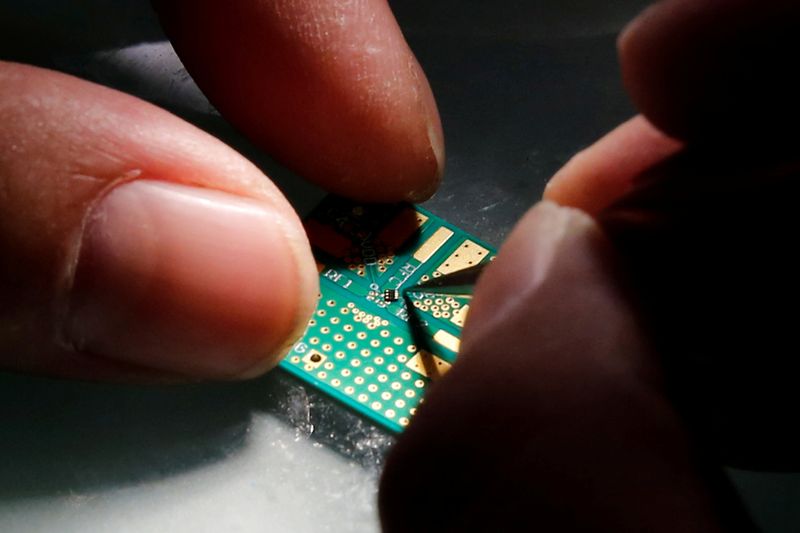

3 semiconductor stocks slashed at Baird

Baird downgraded ON Semiconductor (NASDAQ:ON), STMicroelectronics (NYSE:STM), and Diodes (NASDAQ:DIOD) to Neutral from Outperform with price targets of $60.00 (from $120.00), $35.00 (from $50.00), and $70.00 (from $120.00), respectively, citing supply/demand normalization.

Although pricing remains stable at the moment, said the analysts, they believe the current lead times hint at a potential structural oversupply later next year. The analysts believe this could lead to more broad-based inventory adjustments than previously observed, given that channel inventories are currently at their highest in over 20 years.

“As allocation fears dissipate, inventories are poised to decline, bringing more cancellations with likely negative implications for pricing, which we believe will eventually settle at pre-COVID levels, thus resulting in gross margin declines,” wrote Baird.

ON Semiconductor was additionally hit with downgrades from Craig-Hallum and Summit Insights, which each slashed their ratings to Hold from Buy following the company’s worse-than-expected guidance Tuesday, after which shares plummeted by over 21% in that session.

ON was recently down another 0.8% to $64.08, while Diodes was losing 4.1% to $65.71 near midday. STMicroelectronics, however, was up 1.3% to $38.16.

Lyft slashed to Sell at MoffettNathanson

Lyft (NASDAQ:LYFT) was downgraded to Sell from Neutral at MoffettNathanson with a $7.00 price target, cut from the prior $10.00.

The analysts said they believe the ride-hailing business will "[fail] to reach GAAP profitability or positive GAAP FCF [free cash flow] in our modeling period," noting that their EBITDA targets are 17% below the consensus for 2024, and 25% under for 2025

They added, that they "believe any long-term guidance provided by management will likely disappoint vs expectations."

Still, shares were ticking 0.4% higher to $9.47 in recent trading.

UDR hit with two downgrades after a Q3 miss

UDR (NYSE:UDR) was downgraded by two Wall Street firms Wednesday following the company’s reported Q3 results last week, with both EPS and revenue coming in below the consensus estimates, as reported in real time on InvestingPro.

BofA Securities cut the company to Neutral from Buy and lowered its price target to $33.00 from $42.00. Meanwhile, Piper Sandler downgraded the stock to Underweight from Neutral with a price target of $30.00 (from $46.00).

Sonic Auto cut at JPMorgan

Sonic Automotive (NYSE:SAH) was cut to Underweight from Neutral at JPMorgan with a price target of $50.00 (from $52.00) following the company’s Q3 results last week.

The analysts wrote:

“We continue to see a tough road ahead for EchoPark recovery and our FY2 estimates remain the lowest relative to consensus in the peer group. 3Q23 EchoPark results were better than expected, particularly on the volume ramp despite store closures, though we believe the path to breakeven at EchoPark in 1Q24 is still dependent heavily on industry variables, particularly quicker recovery in supply and pricing."

***

Amid whipsaw markets and a slew of critical headlines, seize on the right timing to protect your profits: Always be the first to know with InvestingPro.