Do Asian Pay Television Trust's (SGX:S7OU) Earnings Warrant Your Attention?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Asian Pay Television Trust (SGX:S7OU). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Asian Pay Television Trust

How Fast Is Asian Pay Television Trust Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Asian Pay Television Trust has grown EPS by 29% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

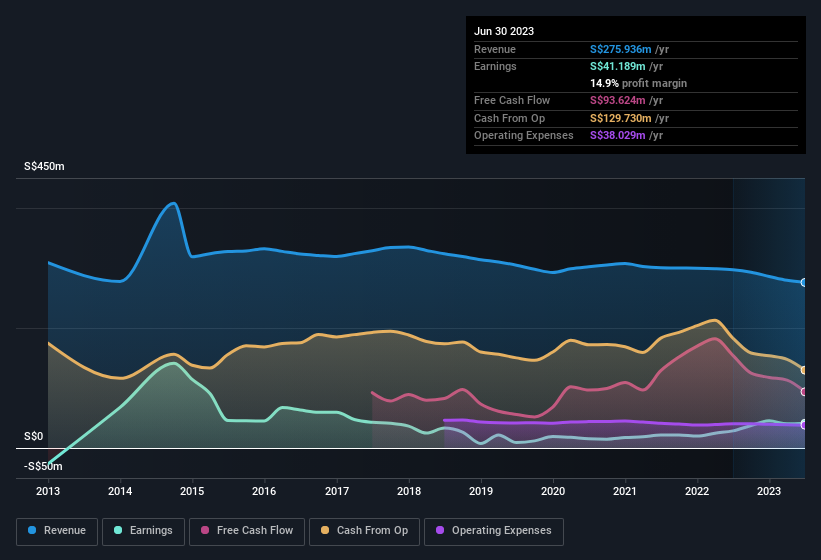

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Despite consistency in EBIT margins year on year, Asian Pay Television Trust has actually recorded a dip in revenue. While this may raise concerns, investors should investigate the reasoning behind this.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Asian Pay Television Trust isn't a huge company, given its market capitalisation of S$173m. That makes it extra important to check on its balance sheet strength.

Are Asian Pay Television Trust Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One positive for Asian Pay Television Trust, is that company insiders spent S$59k acquiring shares in the last year. This might not be a huge sum, but it's well worth noting anyway, given the complete lack of selling. Zooming in, we can see that the biggest insider purchase was by Vice Chair of APTT Management Pte. Limited Fang-Ming Lu for S$22k worth of shares, at about S$0.096 per share.

Should You Add Asian Pay Television Trust To Your Watchlist?

You can't deny that Asian Pay Television Trust has grown its earnings per share at a very impressive rate. That's attractive. The growth rate should be enticing enough to consider researching the company, and the insider buying is a great added bonus. So on this analysis, Asian Pay Television Trust is probably worth spending some time on. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Asian Pay Television Trust (1 is potentially serious) you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Asian Pay Television Trust, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.