Here's Why We Think Sinarmas Land (SGX:A26) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Sinarmas Land (SGX:A26), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Sinarmas Land with the means to add long-term value to shareholders.

See our latest analysis for Sinarmas Land

How Fast Is Sinarmas Land Growing Its Earnings Per Share?

Sinarmas Land has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. In impressive fashion, Sinarmas Land's EPS grew from S$0.044 to S$0.077, over the previous 12 months. Year on year growth of 74% is certainly a sight to behold. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Sinarmas Land shareholders can take confidence from the fact that EBIT margins are up from 41% to 46%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

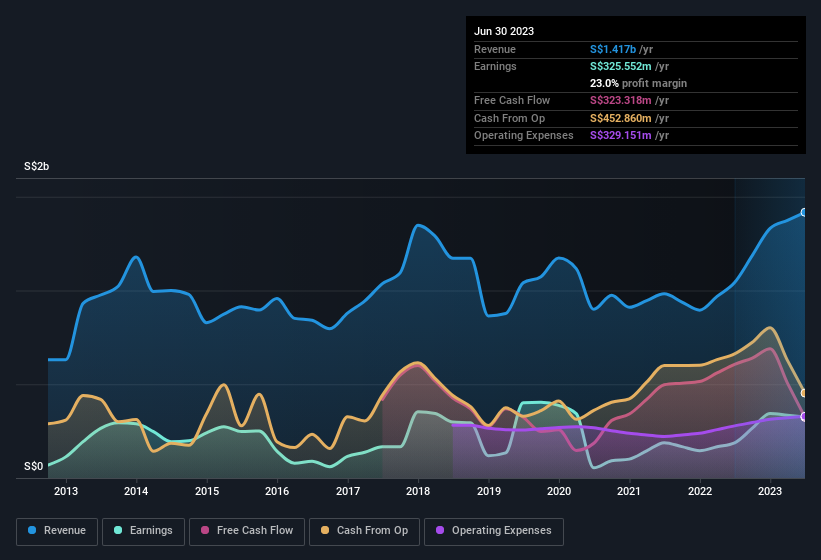

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Sinarmas Land Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But the bigger deal is that the Lead Independent Director, Pian Tee Hong, paid S$72k to buy shares at an average price of S$0.20. Strong buying like that could be a sign of opportunity.

Is Sinarmas Land Worth Keeping An Eye On?

Sinarmas Land's earnings have taken off in quite an impressive fashion. Growth-minded people will be intrigued by the incredible movement in EPS growth. And may very well signal a significant inflection point for the business. If this these factors intrigue you, then an addition of Sinarmas Land to your watchlist won't go amiss. However, before you get too excited we've discovered 1 warning sign for Sinarmas Land that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Sinarmas Land, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.