WTI Oil

WTI oil edged higher on Friday and holding near the ceiling of near-term range, but still without a clear direction.

Signals that oil supplies are tightening, primarily due to the latest decisions of OPEC+ main members, Russia and Saudi Arabia to further cut production and support oil market.

The price was also supported by record imports of Russian oil by China and India, although analysts fear that buying interest from India is going to weaken that would partially offset recent positive signals and limit oil’s gains.

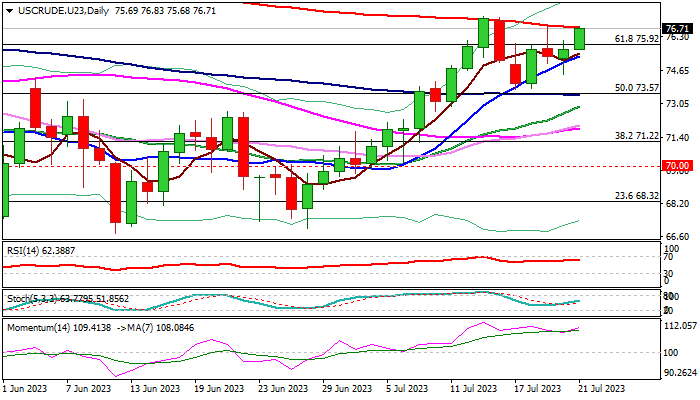

Technical picture on daily chart remains bullish overall, as positive momentum is strong and daily Tenkan-sen / Kijun-sen lines are in bullish configuration, though near-term action was repeatedly capped by falling 200DMA, which reinforces range ceiling and keeps bulls in check.

Near-term action is expected to remain biased higher while holding above rising 10DMA ($75.34), though risk of stall to remain as long as 200DMA caps

We look for initial bullish signal on weekly close above $75.92 (Fibo 61.8% of $83.51/$63.63 descend) which will need confirmation on eventual break through 200DMA ($76.74) and recent tops at $77.30, to signal bullish continuation and expose targets at $78.82 (Fibo 76.4%) and $80.00 (psychological) in extension.

Extended sideways mode could be expected on price action moving between converging 10DMA and 200DMA, while initial bearish signal will be generated on firm break of 10DMA pivot.

Res: 76.74; 77.31; 77.90; 78.82.

Sup: 75.92; 75.34; 74.50; 73.81.

Interested in Oil technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0750 with a negative sentiment amid hawkish Fed

EUR/USD could extend its losses for the third successive session, trading around 1.0750 during the Asian session on Thursday. The US Dollar appreciates amid expectations of the Federal Reserve’s maintaining higher interest rates.

GBP/USD holds below 1.2500 ahead of BoE rate decision

GBP/USD extends its losing streak for the third successive session, trading around 1.2490 during the Asian session on Thursday. Thursday brings the Bank of England interest rate decision, with expectations of maintaining interest rate at 5.25%.

Gold price gains ground, investors await US data, Fedspeak for fresh catalyst

Gold price trades with a positive bias on Thursday amid the absence of top-tier economic data releases at mid-week. However, multiple headwinds, such as the firmer US Dollar and the hawkish comments from the US Federal Reserve are likely to cap the upside of the precious metal in the near term.

President Biden threatens crypto with possible veto of Bitcoin custody among trusted custodians

Joe Biden could veto legislation that would allow regulated financial institutions to custody Bitcoin and crypto. Biden administration’s stance would disrupt US SEC’s work to protect crypto market investors and efforts to safeguard broader financial system.

BoE set to leave interest rates unchanged amid increasing expectations of cuts

It's anticipated that the BoE will maintain the benchmark interest rate at 5.25% after its policy meeting today at 11:00 GMT. Alongside the policy rate announcement, the bank will release the Monetary Policy Minutes and the Monetary Policy Report.