If EPS Growth Is Important To You, Tai Sin Electric (SGX:500) Presents An Opportunity

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Tai Sin Electric (SGX:500). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Tai Sin Electric

How Quickly Is Tai Sin Electric Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Tai Sin Electric managed to grow EPS by 17% per year, over three years. That's a pretty good rate, if the company can sustain it.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Tai Sin Electric is growing revenues, and EBIT margins improved by 4.3 percentage points to 7.5%, over the last year. That's great to see, on both counts.

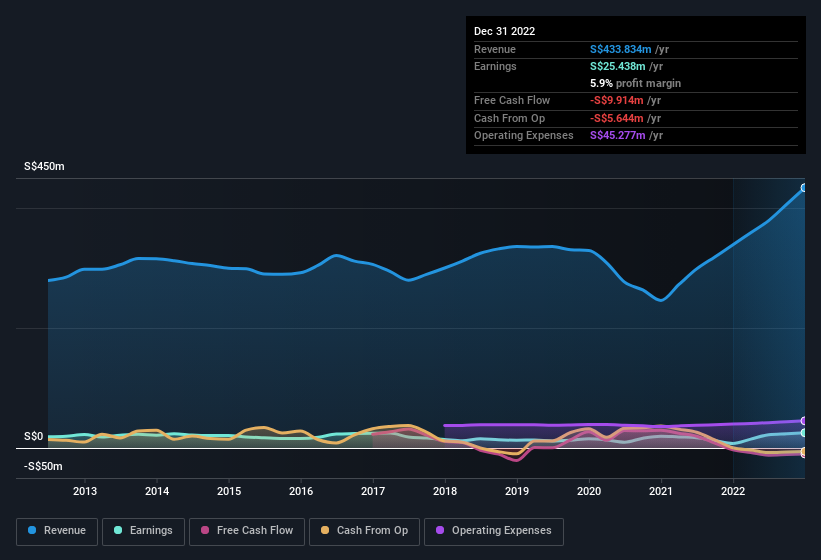

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Tai Sin Electric isn't a huge company, given its market capitalisation of S$186m. That makes it extra important to check on its balance sheet strength.

Are Tai Sin Electric Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We note that Tai Sin Electric insiders spent S$192k on stock, over the last year; in contrast, we didn't see any selling. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading. Zooming in, we can see that the biggest insider purchase was by CEO & Executive Director Boon Hock Lim for S$53k worth of shares, at about S$0.39 per share.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Tai Sin Electric insiders own more than a third of the company. To be exact, company insiders hold 54% of the company, so their decisions have a significant impact on their investments. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. With that sort of holding, insiders have about S$102m riding on the stock, at current prices. That's nothing to sneeze at!

Does Tai Sin Electric Deserve A Spot On Your Watchlist?

One important encouraging feature of Tai Sin Electric is that it is growing profits. In addition, insiders have been busy adding to their sizeable holdings in the company. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. However, before you get too excited we've discovered 1 warning sign for Tai Sin Electric that you should be aware of.

The good news is that Tai Sin Electric is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance