Is Now The Time To Put Uni-Asia Group (SGX:CHJ) On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Uni-Asia Group (SGX:CHJ). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Uni-Asia Group with the means to add long-term value to shareholders.

View our latest analysis for Uni-Asia Group

How Quickly Is Uni-Asia Group Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. To the delight of shareholders, Uni-Asia Group has achieved impressive annual EPS growth of 49%, compound, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

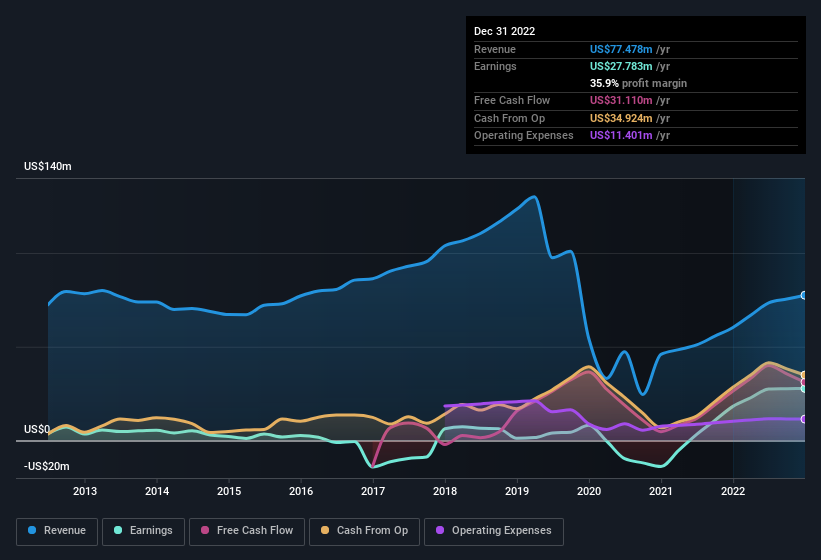

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Uni-Asia Group's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. Uni-Asia Group shareholders can take confidence from the fact that EBIT margins are up from 17% to 29%, and revenue is growing. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Uni-Asia Group isn't a huge company, given its market capitalisation of S$70m. That makes it extra important to check on its balance sheet strength.

Are Uni-Asia Group Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

In the last year insider at Uni-Asia Group were both selling and buying shares; but happily, as a group they spent US$127k more on stock, than they netted from selling it. Shareholders who may have questioned insiders selling will find some reassurance in this fact. Zooming in, we can see that the biggest insider purchase was by Co-Founder & Chairman Michio Tanamoto for S$224k worth of shares, at about S$1.12 per share.

Should You Add Uni-Asia Group To Your Watchlist?

Uni-Asia Group's earnings per share growth have been climbing higher at an appreciable rate. Growth-minded people will be intrigued by the incredible movement in EPS growth. And indeed, it could be a sign that the business is at an inflection point. If this these factors intrigue you, then an addition of Uni-Asia Group to your watchlist won't go amiss. It's still necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Uni-Asia Group (at least 1 which is significant) , and understanding these should be part of your investment process.

Keen growth investors love to see insider buying. Thankfully, Uni-Asia Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance