It's A Story Of Risk Vs Reward With Irish Continental Group plc (LON:ICGC)

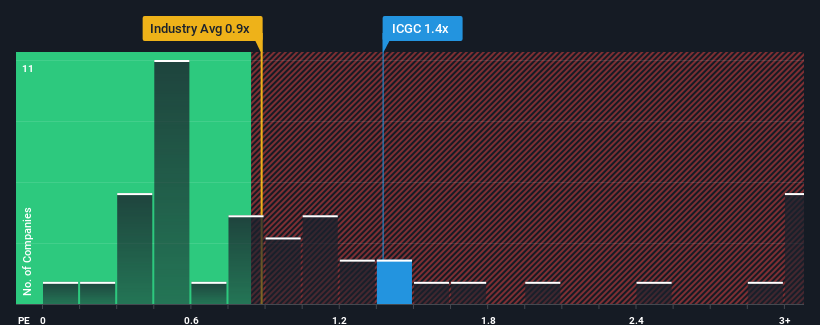

It's not a stretch to say that Irish Continental Group plc's (LON:ICGC) price-to-sales (or "P/S") ratio of 1.4x right now seems quite "middle-of-the-road" for companies in the Shipping industry in the United Kingdom, where the median P/S ratio is around 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Irish Continental Group

How Irish Continental Group Has Been Performing

Irish Continental Group certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Irish Continental Group.

How Is Irish Continental Group's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Irish Continental Group's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 75%. The latest three year period has also seen an excellent 64% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue growth will show minor resilience over the next year growing only by 4.0%. Meanwhile, the broader industry is forecast to contract by 29%, which would indicate the company is doing better than the majority of its peers.

Despite the marginal growth, we find it odd that Irish Continental Group is trading at a fairly similar P/S to the industry. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

What We Can Learn From Irish Continental Group's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Irish Continental Group's analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't resulting in the company trading at a higher P/S, as per our expectations. There could be some unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. The market could be pricing in the event that tough industry conditions will impact future revenues. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Plus, you should also learn about these 3 warning signs we've spotted with Irish Continental Group (including 1 which is potentially serious).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here