OTS Holdings Limited (Catalist:OTS) Not Flying Under The Radar

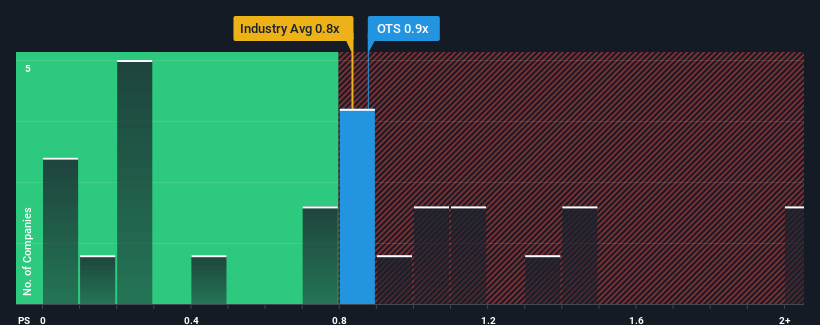

With a median price-to-sales (or "P/S") ratio of close to 0.8x in the Food industry in Singapore, you could be forgiven for feeling indifferent about OTS Holdings Limited's (Catalist:OTS) P/S ratio of 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for OTS Holdings

How Has OTS Holdings Performed Recently?

For example, consider that OTS Holdings' financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on OTS Holdings' earnings, revenue and cash flow.

What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like OTS Holdings' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 9.4% decrease to the company's top line. As a result, revenue from three years ago have also fallen 5.2% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

It's interesting to note that the rest of the industry is similarly expected to decline by 1.4% over the next year, which is just as bad as the company's recent medium-term revenue decline.

In light of this, it's understandable that OTS Holdings' P/S sits in line with the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S long-term, which could set up shareholders for future disappointment regardless. There is potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, our analysis of OTS Holdings confirms that the company's contraction in revenue over the past three-year years is a major contributor to its industry-matching P/S, given the industry is set to decline in a similar fashion. At this stage investors feel the company's revenue potential is similar enough to its peers that it doesn't warrant a higher or lower P/S. Although, we are concerned whether the company's performance will worsen relative to other industry players under these tough industry conditions. If the company's performance remains relatively stable, it's likely that the current share price will continue to find support.

Plus, you should also learn about these 5 warning signs we've spotted with OTS Holdings (including 2 which shouldn't be ignored).

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance