Here's Why We Think Mapletree Industrial Trust (SGX:ME8U) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Mapletree Industrial Trust (SGX:ME8U). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Mapletree Industrial Trust with the means to add long-term value to shareholders.

See our latest analysis for Mapletree Industrial Trust

Mapletree Industrial Trust's Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So EPS growth can certainly encourage an investor to take note of a stock. Outstandingly, Mapletree Industrial Trust's EPS shot from S$0.091 to S$0.16, over the last year. Year on year growth of 78% is certainly a sight to behold.

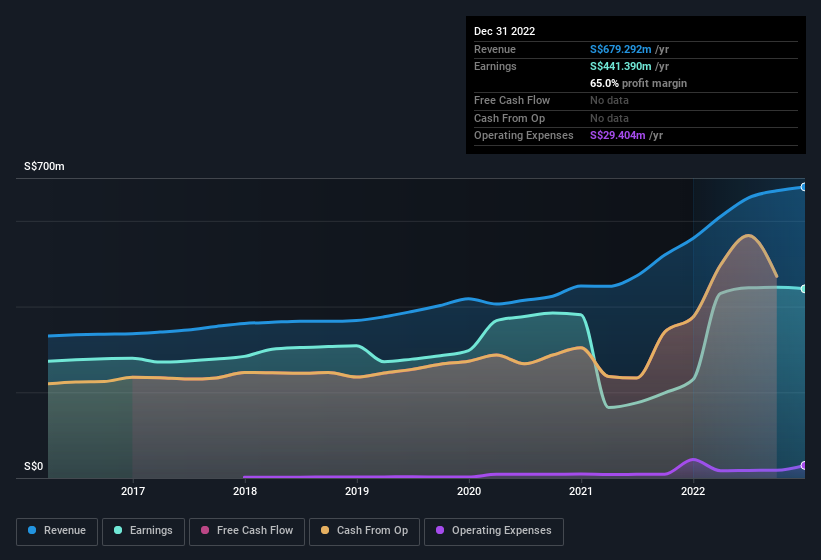

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While Mapletree Industrial Trust did well to grow revenue over the last year, EBIT margins were dampened at the same time. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Mapletree Industrial Trust's future EPS 100% free.

Are Mapletree Industrial Trust Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Shareholders in Mapletree Industrial Trust will be more than happy to see insiders committing themselves to the company, spending S$420k on shares in just twelve months. When you contrast that with the complete lack of sales, it's easy for shareholders to be brimming with joyful expectancy. It is also worth noting that it was Non-Executive Chairman of Mapletree Industrial Trust Management Ltd. Kim Teck Cheah who made the biggest single purchase, worth S$247k, paying S$2.47 per share.

Is Mapletree Industrial Trust Worth Keeping An Eye On?

Mapletree Industrial Trust's earnings per share growth have been climbing higher at an appreciable rate. Growth-minded people will be intrigued by the incredible movement in EPS growth. And may very well signal a significant inflection point for the business. If this is the case, then keeping a watch over Mapletree Industrial Trust could be in your best interest. We should say that we've discovered 2 warning signs for Mapletree Industrial Trust (1 doesn't sit too well with us!) that you should be aware of before investing here.

Keen growth investors love to see insider buying. Thankfully, Mapletree Industrial Trust isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance