While not a mind-blowing move, it is good to see that the Teva Pharmaceutical Industries Limited (NYSE:TEVA) share price has gained 14% in the last three months. But that is little comfort to those holding over the last half decade, sitting on a big loss. In fact, the share price has declined rather badly, down some 52% in that time. Some might say the recent bounce is to be expected after such a bad drop. But it could be that the fall was overdone.

After losing 3.3% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Teva Pharmaceutical Industries

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Teva Pharmaceutical Industries became profitable within the last five years. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. Other metrics may better explain the share price move.

Arguably, the revenue drop of 7.6% a year for half a decade suggests that the company can't grow in the long term. That could explain the weak share price.

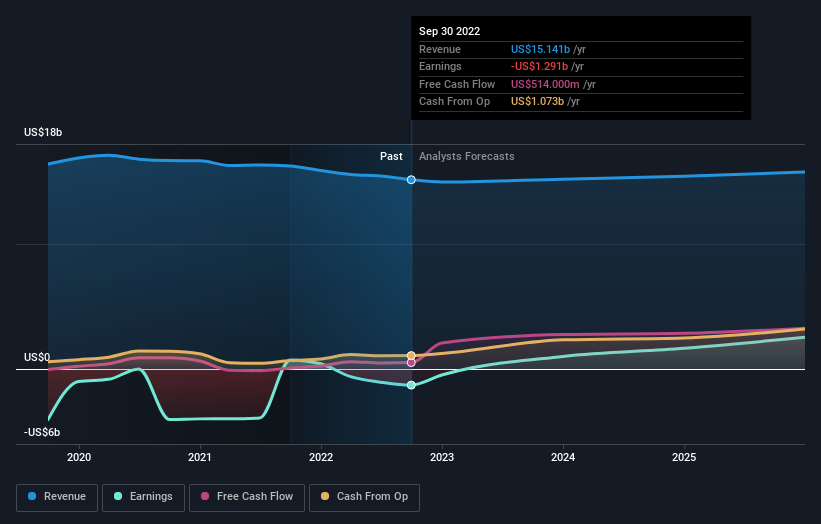

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Teva Pharmaceutical Industries is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Teva Pharmaceutical Industries stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

It's nice to see that Teva Pharmaceutical Industries shareholders have received a total shareholder return of 24% over the last year. That certainly beats the loss of about 9% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.