Cerence Inc. (NASDAQ:CRNC) shareholders will doubtless be very grateful to see the share price up 39% in the last quarter. But that doesn't change the fact that the returns over the last year have been disappointing. During that time the share price has sank like a stone, descending 60%. It's not that amazing to see a bounce after a drop like that. Of course, it could be that the fall was overdone.

The recent uptick of 9.6% could be a positive sign of things to come, so let's take a look at historical fundamentals.

View our latest analysis for Cerence

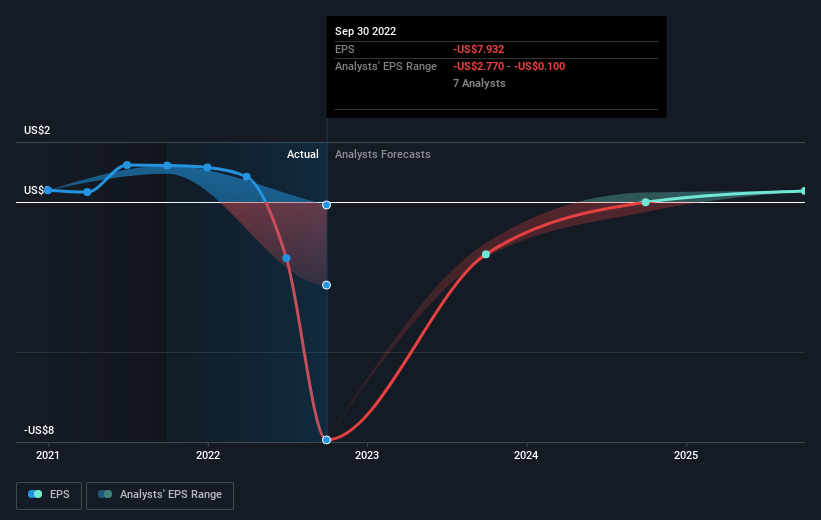

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Cerence fell to a loss making position during the year. Buyers no doubt think it's a temporary situation, but those with a nose for quality have low tolerance for losses. However, there may be an opportunity for investors if the company can recover.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Dive deeper into Cerence's key metrics by checking this interactive graph of Cerence's earnings, revenue and cash flow.

A Different Perspective

The last twelve months weren't great for Cerence shares, which performed worse than the market, costing holders 60%. Meanwhile, the broader market slid about 6.9%, likely weighing on the stock. Fortunately the longer term story is brighter, with total returns averaging about 2.1% per year over three years. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. If you would like to research Cerence in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.