Unfortunately, investing is risky - companies can and do go bankrupt. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the Prometheus Biosciences, Inc. (NASDAQ:RXDX) share price has soared 262% in the last 1 year. Most would be very happy with that, especially in just one year! Also pleasing for shareholders was the 112% gain in the last three months. Prometheus Biosciences hasn't been listed for long, so it's still not clear if it is a long term winner.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

View our latest analysis for Prometheus Biosciences

Prometheus Biosciences wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last twelve months, Prometheus Biosciences' revenue grew by 182%. That's a head and shoulders above most loss-making companies. And the share price has responded, gaining 262% as we previously mentioned. That sort of revenue growth is bound to attract attention, even if the company doesn't turn a profit. Given the positive sentiment around the stock we're cautious, but there's no doubt its worth watching.

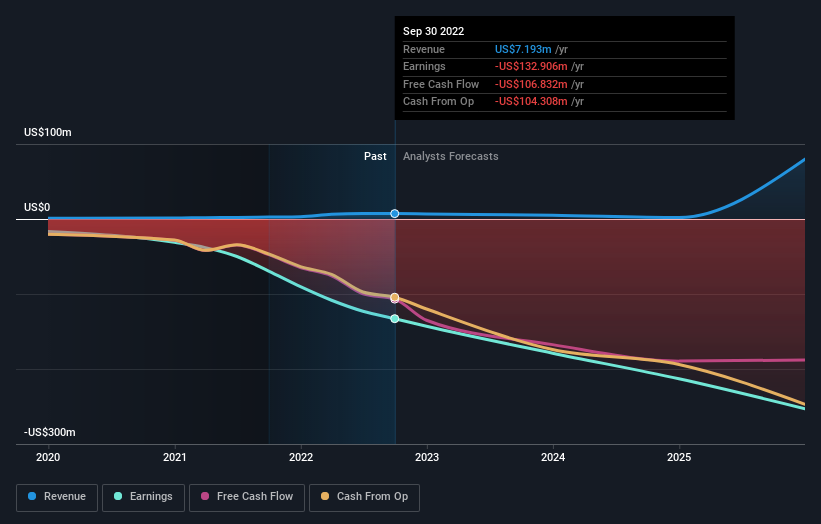

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Prometheus Biosciences is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Prometheus Biosciences stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

It's nice to see that Prometheus Biosciences shareholders have gained 262% over the last year. And the share price momentum remains respectable, with a gain of 112% in the last three months. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for Prometheus Biosciences you should be aware of, and 1 of them shouldn't be ignored.

We will like Prometheus Biosciences better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.