Aurora Innovation, Inc. (NASDAQ:AUR) shareholders should be happy to see the share price up 11% in the last month. But that doesn't change the fact that the returns over the last year have been stomach churning. During that time the share price has plummeted like a stone, down 81%. Arguably, the recent bounce is to be expected after such a bad drop. The bigger issue is whether the company can sustain the momentum in the long term. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

On a more encouraging note the company has added US$116m to its market cap in just the last 7 days, so let's see if we can determine what's driven the one-year loss for shareholders.

See our latest analysis for Aurora Innovation

Given that Aurora Innovation didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last twelve months, Aurora Innovation increased its revenue by 66%. That's a strong result which is better than most other loss making companies. So the hefty 81% share price crash makes us think the company has somehow offended market participants. There's clearly something unusual going on here such as an acquisition that hasn't delivered expected profits. We'd recommend taking a very close look at the stock (and any available forecasts), before considering a purchase, because the share price is not correlated with the revenue growth, that's for sure. Of course, markets do over-react so share price drop may be too harsh.

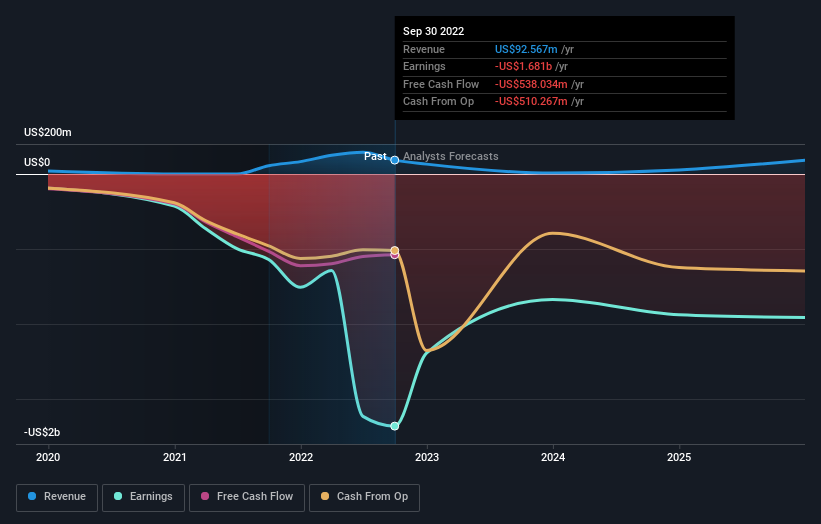

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So it makes a lot of sense to check out what analysts think Aurora Innovation will earn in the future (free profit forecasts).

A Different Perspective

Aurora Innovation shareholders are down 81% for the year, even worse than the market loss of 15%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 37% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand Aurora Innovation better, we need to consider many other factors. For instance, we've identified 2 warning signs for Aurora Innovation that you should be aware of.

Of course Aurora Innovation may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.