Potbelly (PBPB) Provides Prelim Results for Q4 & Fiscal 2022

Potbelly Corporation PBPB provided an update on its business and financial results for the fourth quarter and fiscal 2022. In line with its 2024 and long-term growth objectives, the company exceeded its guided range for all the metrics.

For the fiscal fourth quarter, Potbelly anticipated revenues of $114-$119 million and shop-level margins in 10-13% range. The prelim results show revenues of $119-$120 million and shop-level margins of 13.4-13.9%. Also, same-store sales came in at 18.5-19% and AUVs totaled $24,100-$24,200.

For fiscal 2022, it expected shop-level margins of approximately 10%, same-store sales came of 16-18% and AUVs between $1.14-$1.16 million. Per the prelim results, it generated shop-level margins of 10.2-10.4%, same-store sales came within 18.4-18.5% and AUVs totaled $1.16-$1.17 million.

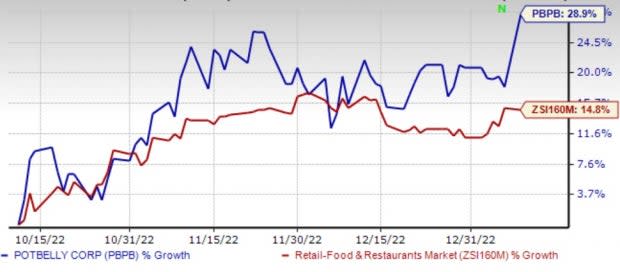

Shares of the company gained 9.8% on Jan 9 and 28.9% in the past three months, outperforming the industry’s 14.8% growth.

Image Source: Zacks Investment Research

President and chief executive officer of Potbelly, Bob Wright, said, “Our team’s execution of our Five-Pillar Strategy initiatives enabled us to surpass our previously stated fourth quarter and full-year 2022 guidance based on our preliminary results. We also made meaningful progress against our Franchise Growth Acceleration Initiative, having signed agreements for 51 new shops so far, with more deals in the pipeline. I am highly confident in Potbelly’s unique brand and its ability to continue on its path of growth and profitability.”

The company expects to release its fourth quarter and fiscal 2022 results in March 2023.

Zacks Rank & Key Picks

Potbelly currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the Zacks Retail-Wholesale sector are Tecnoglass Inc. TGLS, Wingstop Inc. WING and Darden Restaurants, Inc. DRI.

Tecnoglass currently sports a Zacks Rank #1. Shares of the company have gained 35.3% in the past year.

The Zacks Consensus Estimate for TGLS’ 2023 sales and EPS suggests growth of 11.5% and 9%, respectively, from the year-ago period’s levels.

Wingstop carries a Zacks Rank #2 (Buy). Shares of WING have decreased 11.9% in the past year.

The Zacks Consensus Estimate for Wingstop’s 2023 sales and EPS suggests growth of 18.4% and 16.3%, respectively, from the comparable year-ago period’s levels.

Darden carries a Zacks Rank #2. Shares of DRI have gained 2.1% in the past year.

The Zacks Consensus Estimate for Darden’s fiscal 2023 sales and EPS suggests growth of 7.9% and 5.5%, respectively, from the corresponding year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Darden Restaurants, Inc. (DRI) : Free Stock Analysis Report

Potbelly Corporation (PBPB) : Free Stock Analysis Report

Tecnoglass Inc. (TGLS) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance