It is a pleasure to report that the China Dongxiang (Group) Co., Ltd. (HKG:3818) is up 40% in the last quarter. But don't envy holders -- looking back over 5 years the returns have been really bad. Indeed, the share price is down 73% in the period. So we're hesitant to put much weight behind the short term increase. Of course, this could be the start of a turnaround.

On a more encouraging note the company has added HK$557m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

View our latest analysis for China Dongxiang (Group)

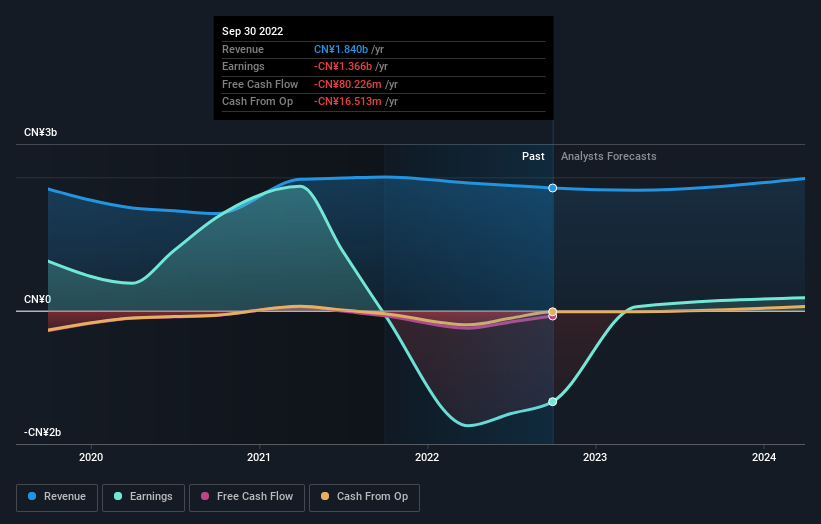

Given that China Dongxiang (Group) didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over five years, China Dongxiang (Group) grew its revenue at 5.7% per year. That's far from impressive given all the money it is losing. Nonetheless, it's fair to say the rapidly declining share price (down 12%, compound, over five years) suggests the market is very disappointed with this level of growth. We'd be pretty cautious about this one, although the sell-off may be too severe. A company like this generally needs to produce profits before it can find favour with new investors.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think China Dongxiang (Group) will earn in the future (free profit forecasts).

What About The Total Shareholder Return (TSR)?

We've already covered China Dongxiang (Group)'s share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. China Dongxiang (Group)'s TSR of was a loss of 62% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

While the broader market lost about 9.8% in the twelve months, China Dongxiang (Group) shareholders did even worse, losing 37%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

China Dongxiang (Group) is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.