AngioDynamics (ANGO) Q2 Earnings, Revenues Top Estimates

AngioDynamics, Inc. ANGO reported adjusted earnings per share (EPS) of a penny for second-quarter fiscal 2023 against the year-ago loss of 2 cents per share. The EPS compares with the Zacks Consensus Estimate of a loss of a penny per share.

Our projection of adjusted loss per share was also a penny, in line with the Zacks Consensus Estimate.

GAAP loss per share came in at 21 cents, flat year over year.

Revenue Details

Revenues in the fiscal second quarter totaled $85.4 million, up 9.1% year over year on a reported basis (up 9.7% at constant exchange rate or CER).

The top line beat the Zacks Consensus Estimate by 1.7%.

The fiscal second-quarter revenue compares to our estimate of $83.9 million.

The company continued to see strong contributions from its Med Tech (which include the Thrombectomy platform, Auryon and NanoKnife) and Med Device businesses during the quarter.

Geographical Analysis

In the quarter under review, U.S. net revenues totaled $71.6 million, up 9.6% year over year.

This figure compares to our U.S. net revenues’ fiscal second-quarter projection of $70.7 million.

International revenues came in at $13.8 million, up 6.7% from the year-ago quarter on a reported basis and up 10.2% at CER.

This figure compares to our fiscal second-quarter International revenues’ projection of $13.2 million.

Segmental Analysis

AngioDynamics derives revenues from two businesses — Med Tech and Med Device.

The Med Tech business’ net sales in the fiscal second quarter were $24.5 million, reflecting an uptick of 29.7% year over year. This was primarily on the back of increased net sales of Auryon amounting to $10.1 million (up 60.6%), NanoKnife sales of $5.5 million (up 49.5%) and NanoKnife disposable sales of $4.2 million (up 45.4%) compared to the prior-year quarter.

This figure compares to our fiscal second quarter’s Med Tech business’ net sales projection of $23.5 million.

Med Device revenues in the fiscal second quarter grossed $60.9 million, up 2.6% from the year-ago period.

This figure compares to our fiscal second quarter’s Med Device business’ net sales projection of $60.4 million.

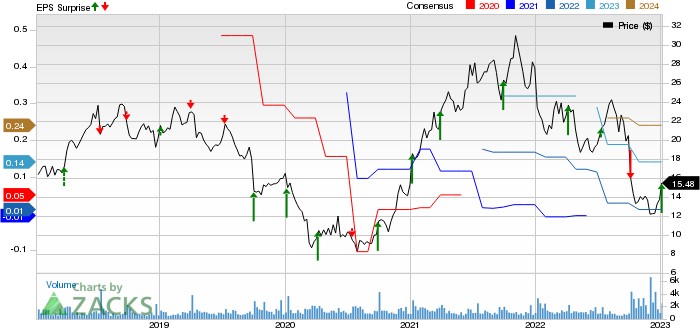

AngioDynamics, Inc. Price, Consensus and EPS Surprise

AngioDynamics, Inc. price-consensus-eps-surprise-chart | AngioDynamics, Inc. Quote

Margin Analysis

In the quarter under review, AngioDynamics’ gross profit rose 11.2% to $45.1 million. The gross margin expanded 96 basis points to 52.8%.

We had projected 54.7% of gross margin for second-quarter fiscal 2023.

Sales and marketing expenses rose 10.2% to $26 million year over year. Research and development expenses decreased 16.6% year over year to $6.8 million, whereas general and administrative expenses rose 11.9% year over year to $10.8 million. Adjusted operating expenses of $43.7 million increased 5.3% year over year.

The adjusted operating profit totaled $1.4 million against the prior-year quarter’s adjusted operating loss of $0.9 million.

Cash Position

AngioDynamics exited the second quarter of fiscal 2023 with cash and cash equivalents of $29.9 million compared with $24.6 million at the end of the fiscal first quarter. The long-term debt (net of current portion) at the end of second-quarter fiscal 2023 was $49.8 million, flat compared with that at the end of the fiscal first quarter.

Cumulative net cash used in operating activities came in at $17.2 million compared with net cash used in operating activities of $6.9 million a year ago.

FY23 Guidance

AngioDynamics has reiterated its guidance for fiscal 2023.

The company continues to expect its net sales in the range of $342-$348 million. The Zacks Consensus Estimate for the same currently stands at $342.7 million.

The adjusted EPS range is projected to be between a penny and 6 cents per share. The Zacks Consensus Estimate for the metric is currently pegged at a penny.

Our Take

AngioDynamics exited the second quarter of fiscal 2023 with better-than-expected results. The company continued gaining from its Med Tech and Med Device businesses. Its year-over-year uptick in revenues and solid domestic and international revenues are impressive. Robust sales of Auryon looks encouraging. Positive physician feedback for AlphaVac products, including the F22 and F18 versions, raises optimism.

During the fiscal second quarter, AngioDynamics confirmed that it had initiated a limited market release of its hydrophilic coated catheters, which provide improved steerability and deliverability. This raises optimism regarding the stock. The gross margin expansion bodes well for the stock.

However, a decline in mechanical thrombectomy revenue, which include AngioVac and AlphaVac sales, and thrombus management (when including Uni-Fuse) is concerning. AngioDynamics continues to face various macro-related headwinds, including costs associated with the continued tight labor market, raw material inflation and an increase in freight costs, which raise our apprehension.

Zacks Rank & Key Picks

AngioDynamics currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space that are supposed to report earnings soon are Boston Scientific Corporation BSX, Cardinal Health, Inc. CAH and AMN Healthcare Services, Inc. AMN.

The Zacks Consensus Estimate for Boston Scientific’s fourth-quarter 2022 adjusted EPS is currently pegged at 47 cents. The consensus estimate for revenues is pinned at $3.24 billion. Boston Scientific currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Boston Scientific projects 10.3% growth for the next five years. BSX’s earnings yield of 4.1% compares favorably with the industry’s negative yield.

Cardinal Health currently has a Zacks Rank #2. The Zacks Consensus Estimate for its second-quarter fiscal 2023 adjusted EPS is currently pegged at $1.17. The same for revenues is pinned at $49.68 billion.

Cardinal Health has an estimated long-term growth rate of 11.2%. CAH’s earnings yield of 6.9% compares favorably with the industry’s 4.3%.

AMN Healthcare currently carries a Zacks Rank #2. The Zacks Consensus Estimate for its fourth-quarter 2022 adjusted EPS is currently pegged at $2.17. The same for its revenues stands at $1.06 billion.

AMN Healthcare has an estimated long-term growth rate of 3.3%. AMN’s earnings yield of 8.1% compares favorably with the industry’s negative yield.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

AngioDynamics, Inc. (ANGO) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance