This month, we saw the Agora, Inc. (NASDAQ:API) up an impressive 47%. But that's small comfort given the dismal price performance over the last year. Like an arid lake in a warming world, shareholder value has evaporated, with the share price down 69% in that time. The share price recovery is not so impressive when you consider the fall. Arguably, the fall was overdone.

While the stock has risen 16% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out our latest analysis for Agora

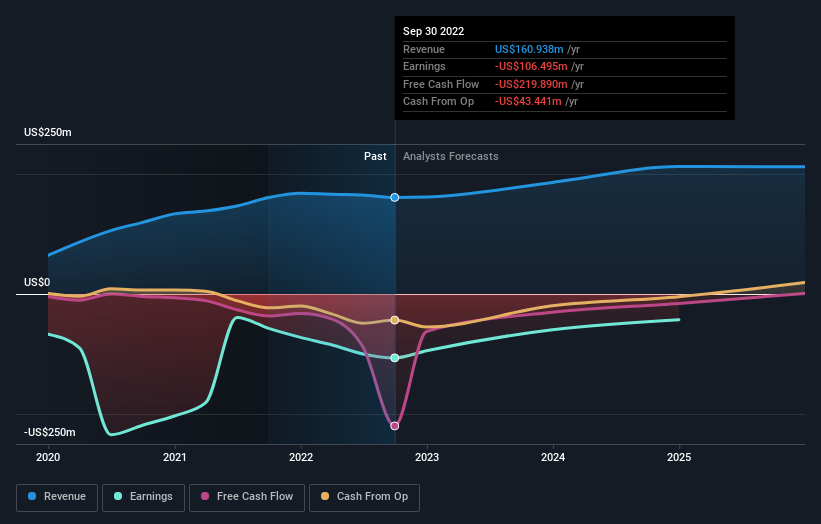

Given that Agora didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last twelve months, Agora increased its revenue by 0.06%. While that may seem decent it isn't great considering the company is still making a loss. It's likely this muted growth has contributed to the share price decline of 69% in the last year. Like many holders, we really want to see better revenue growth in companies that lose money. Of course, the market can be too impatient at times. Why not take a closer look at this one so you're ready to pounce if growth does accelerate.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We doubt Agora shareholders are happy with the loss of 69% over twelve months. That falls short of the market, which lost 20%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. It's great to see a nice little 33% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Agora is showing 2 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

We will like Agora better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.