Anhui Xinbo Aluminum Co., Ltd. (SZSE:003038) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 45% share price drop.

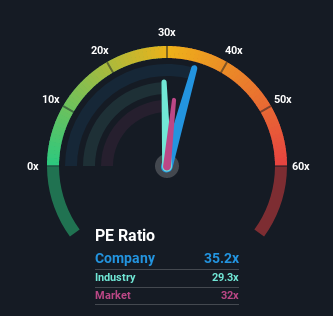

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Anhui Xinbo Aluminum's P/E ratio of 35.2x, since the median price-to-earnings (or "P/E") ratio in China is also close to 32x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been pleasing for Anhui Xinbo Aluminum as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Anhui Xinbo Aluminum

SZSE:003038 Price Based on Past Earnings December 23rd 2022 Want the full picture on analyst estimates for the company? Then our free report on Anhui Xinbo Aluminum will help you uncover what's on the horizon.

SZSE:003038 Price Based on Past Earnings December 23rd 2022 Want the full picture on analyst estimates for the company? Then our free report on Anhui Xinbo Aluminum will help you uncover what's on the horizon. What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Anhui Xinbo Aluminum's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 31%. The latest three year period has also seen an excellent 60% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 70% as estimated by the only analyst watching the company. With the market only predicted to deliver 42%, the company is positioned for a stronger earnings result.

With this information, we find it interesting that Anhui Xinbo Aluminum is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Following Anhui Xinbo Aluminum's share price tumble, its P/E is now hanging on to the median market P/E. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Anhui Xinbo Aluminum currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Before you take the next step, you should know about the 5 warning signs for Anhui Xinbo Aluminum (2 can't be ignored!) that we have uncovered.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a P/E below 20x.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.