The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on a lighter note, a good company can see its share price rise well over 100%. Long term Foshan Yowant Technology Co.,Ltd (SZSE:002291) shareholders would be well aware of this, since the stock is up 116% in five years. Better yet, the share price has risen 5.3% in the last week. But this could be related to the buoyant market which is up about 2.3% in a week.

The past week has proven to be lucrative for Foshan Yowant TechnologyLtd investors, so let's see if fundamentals drove the company's five-year performance.

View our latest analysis for Foshan Yowant TechnologyLtd

Foshan Yowant TechnologyLtd isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 5 years Foshan Yowant TechnologyLtd saw its revenue grow at 20% per year. That's well above most pre-profit companies. Meanwhile, its share price performance certainly reflects the strong growth, given the share price grew at 17% per year, compound, during the period. So it seems likely that buyers have paid attention to the strong revenue growth. To our minds that makes Foshan Yowant TechnologyLtd worth investigating - it may have its best days ahead.

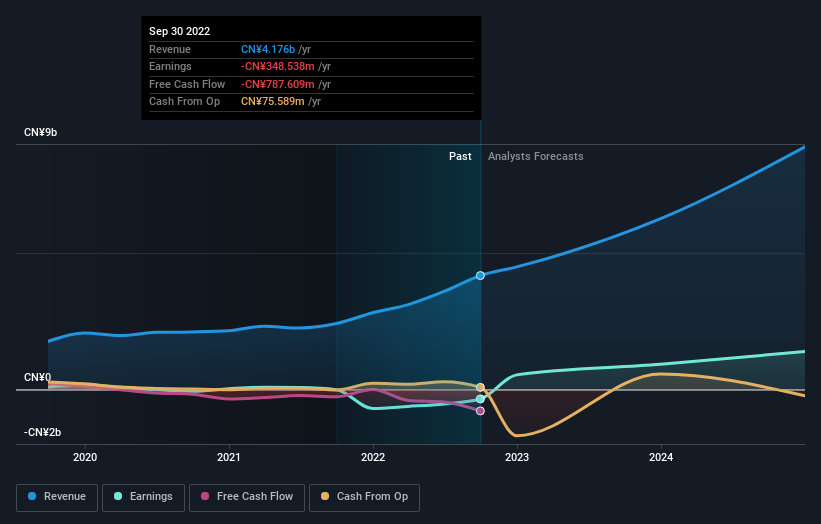

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

SZSE:002291 Earnings and Revenue Growth December 8th 2022

SZSE:002291 Earnings and Revenue Growth December 8th 2022This free interactive report on Foshan Yowant TechnologyLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market lost about 16% in the twelve months, Foshan Yowant TechnologyLtd shareholders did even worse, losing 25%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 17%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course Foshan Yowant TechnologyLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CN exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.