It certainly might concern Smart Globe Holdings Limited (HKG:1481) shareholders to see the share price down 65% in just 30 days. But over the last three years the stock has shone bright like a diamond. Over that time, we've been excited to watch the share price climb an impressive 395%. As long term investors the recent fall doesn't detract all that much from the longer term story. The thing to consider is whether there is still too much elation around the company's prospects.

Although Smart Globe Holdings has shed HK$775m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for Smart Globe Holdings

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the three years of share price growth, Smart Globe Holdings actually saw its earnings per share (EPS) drop 61% per year.

Thus, it seems unlikely that the market is focussed on EPS growth at the moment. Given this situation, it makes sense to look at other metrics too.

It could be that the revenue growth of 8.5% per year is viewed as evidence that Smart Globe Holdings is growing. If the company is being managed for the long term good, today's shareholders might be right to hold on.

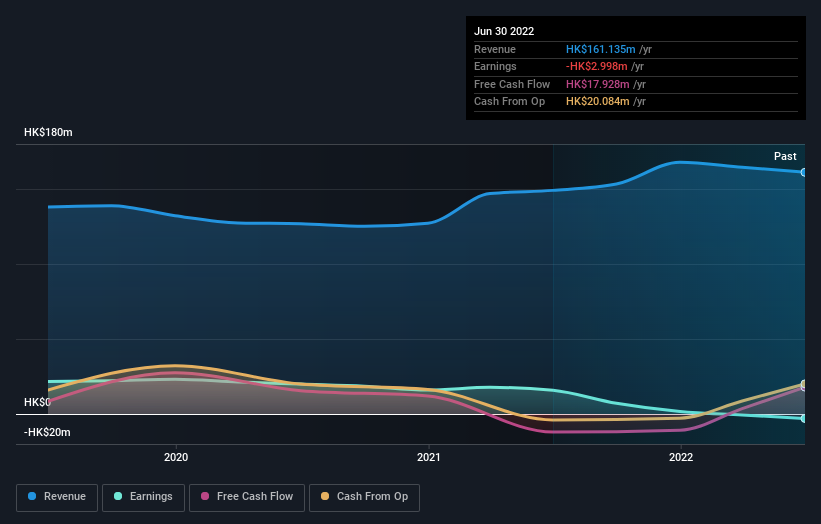

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

SEHK:1481 Earnings and Revenue Growth October 19th 2022

SEHK:1481 Earnings and Revenue Growth October 19th 2022It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Smart Globe Holdings' earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

We've already covered Smart Globe Holdings' share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Smart Globe Holdings shareholders, and that cash payout contributed to why its TSR of 416%, over the last 3 years, is better than the share price return.

A Different Perspective

We're pleased to report that Smart Globe Holdings rewarded shareholders with a total shareholder return of 130% over the last year. So this year's TSR was actually better than the three-year TSR (annualized) of 73%. Given the track record of solid returns over varying time frames, it might be worth putting Smart Globe Holdings on your watchlist. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Smart Globe Holdings you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.