Evercore Inc. (NYSE:EVR) shareholders should be happy to see the share price up 14% in the last week. But that doesn't change the reality of under-performance over the last twelve months. After all, the share price is down 36% in the last year, significantly under-performing the market.

The recent uptick of 14% could be a positive sign of things to come, so let's take a lot at historical fundamentals.

Check out our latest analysis for Evercore

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate twelve months during which the Evercore share price fell, it actually saw its earnings per share (EPS) improve by 35%. It could be that the share price was previously over-hyped.

The divergence between the EPS and the share price is quite notable, during the year. But we might find some different metrics explain the share price movements better.

Evercore's revenue is actually up 22% over the last year. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

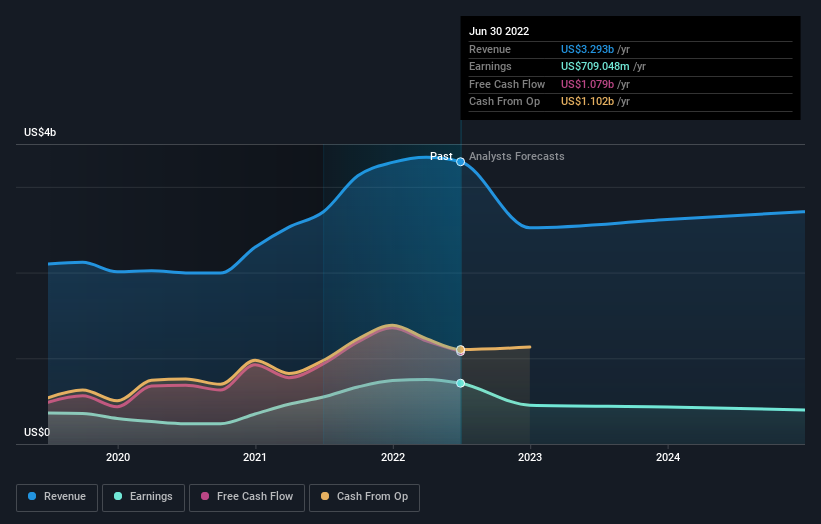

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

NYSE:EVR Earnings and Revenue Growth October 5th 2022

NYSE:EVR Earnings and Revenue Growth October 5th 2022We know that Evercore has improved its bottom line lately, but what does the future have in store? So it makes a lot of sense to check out what analysts think Evercore will earn in the future (free profit forecasts).

A Different Perspective

While the broader market lost about 17% in the twelve months, Evercore shareholders did even worse, losing 35% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 6%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Evercore , and understanding them should be part of your investment process.

Of course Evercore may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.