Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. That downside risk was realized by Cannae Holdings, Inc. (NYSE:CNNE) shareholders over the last year, as the share price declined 35%. That's disappointing when you consider the market declined 22%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 25% in three years.

The recent uptick of 4.7% could be a positive sign of things to come, so let's take a lot at historical fundamentals.

See our latest analysis for Cannae Holdings

Because Cannae Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last twelve months, Cannae Holdings increased its revenue by 3.7%. While that may seem decent it isn't great considering the company is still making a loss. Given this lacklustre revenue growth, the share price drop of 35% seems pretty appropriate. In a hot market it's easy to forget growth is the life-blood of a loss making company. But if you buy a loss making company then you could become a loss making investor.

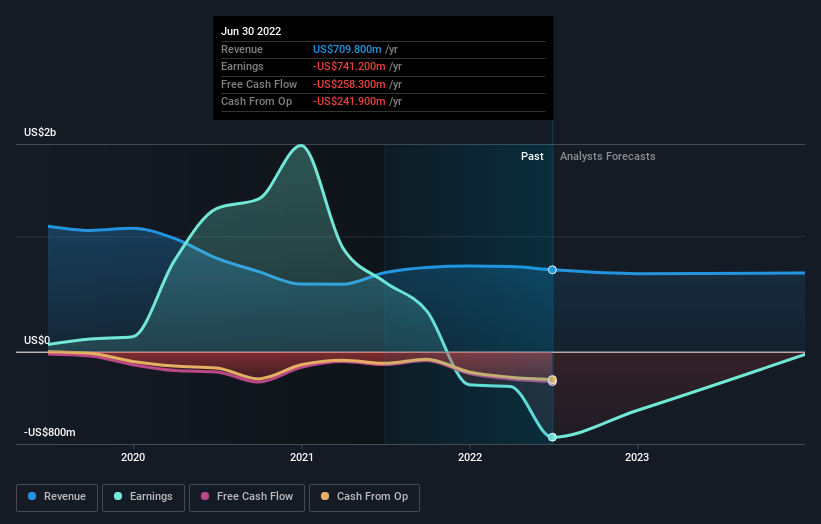

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

NYSE:CNNE Earnings and Revenue Growth October 3rd 2022

NYSE:CNNE Earnings and Revenue Growth October 3rd 2022We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Cannae Holdings will earn in the future (free profit forecasts).

A Different Perspective

Cannae Holdings shareholders are down 35% for the year, falling short of the market return. Meanwhile, the broader market slid about 22%, likely weighing on the stock. The three-year loss of 8% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Cannae Holdings by clicking this link.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.