It's normal to be annoyed when stock you own has a declining share price. But in the short term the market is a voting machine, and the share price movements may not reflect the underlying business performance. So while the Dongguan Rural Commercial Bank Co., Ltd. (HKG:9889) share price is down 12% in the last year, the total return to shareholders (which includes dividends) was -8.1%. And that total return actually beats the market decline of 25%. We wouldn't rush to judgement on Dongguan Rural Commercial Bank because we don't have a long term history to look at.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

Check out our latest analysis for Dongguan Rural Commercial Bank

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Even though the Dongguan Rural Commercial Bank share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped.

It seems quite likely that the market was expecting higher growth from the stock. But other metrics might shed some light on why the share price is down.

We don't see any weakness in the Dongguan Rural Commercial Bank's dividend so the steady payout can't really explain the share price drop. The revenue trend doesn't seem to explain why the share price is down. Unless, of course, the market was expecting a revenue uptick.

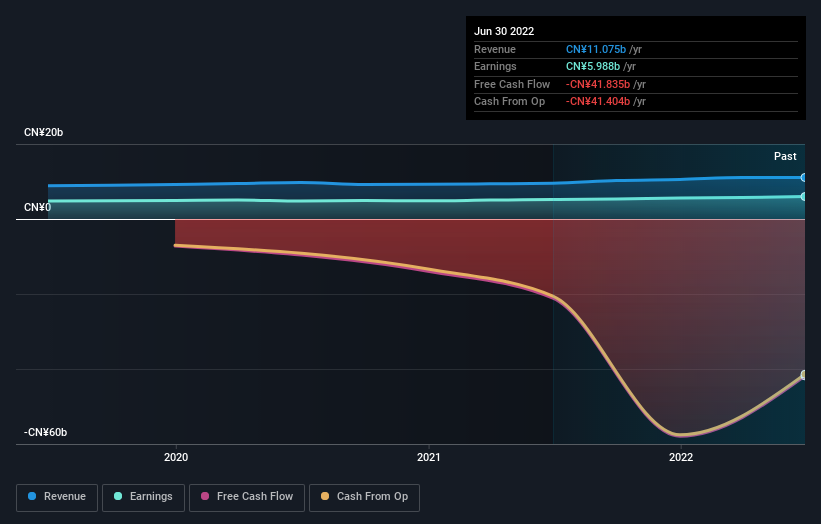

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

SEHK:9889 Earnings and Revenue Growth September 30th 2022

SEHK:9889 Earnings and Revenue Growth September 30th 2022This free interactive report on Dongguan Rural Commercial Bank's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Dongguan Rural Commercial Bank the TSR over the last 1 year was -8.1%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Given that the broader market dropped 25% over the year, the fact that Dongguan Rural Commercial Bank shareholders were down 8.1% isn't so bad. Unfortunately for shareholders, the share price momentum hasn't improved much with the stock down 6.4% in around 90 days. This doesn't look great to us, but it is possible that the market is over-reacting to prior disappointment. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for Dongguan Rural Commercial Bank you should be aware of, and 1 of them is a bit unpleasant.

Of course Dongguan Rural Commercial Bank may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.