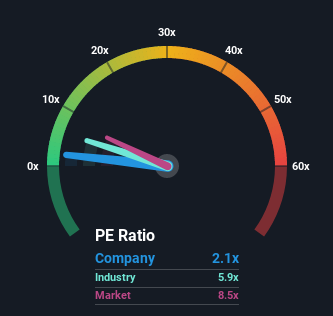

With a price-to-earnings (or "P/E") ratio of 2.1x K. Wah International Holdings Limited (HKG:173) may be sending very bullish signals at the moment, given that almost half of all companies in Hong Kong have P/E ratios greater than 9x and even P/E's higher than 19x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, K. Wah International Holdings has been doing quite well of late. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for K. Wah International Holdings

SEHK:173 Price Based on Past Earnings September 30th 2022 If you'd like to see what analysts are forecasting going forward, you should check out our free report on K. Wah International Holdings.

SEHK:173 Price Based on Past Earnings September 30th 2022 If you'd like to see what analysts are forecasting going forward, you should check out our free report on K. Wah International Holdings. How Is K. Wah International Holdings' Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like K. Wah International Holdings' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 146% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 26% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to slump, contracting by 58% during the coming year according to the lone analyst following the company. That's not great when the rest of the market is expected to grow by 20%.

With this information, we are not surprised that K. Wah International Holdings is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From K. Wah International Holdings' P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of K. Wah International Holdings' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware K. Wah International Holdings is showing 2 warning signs in our investment analysis, and 1 of those is a bit unpleasant.

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E's below 20x.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.