This week we saw the Zhou Hei Ya International Holdings Company Limited (HKG:1458) share price climb by 15%. But in truth the last year hasn't been good for the share price. The cold reality is that the stock has dropped 47% in one year, under-performing the market.

While the stock has risen 15% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

See our latest analysis for Zhou Hei Ya International Holdings

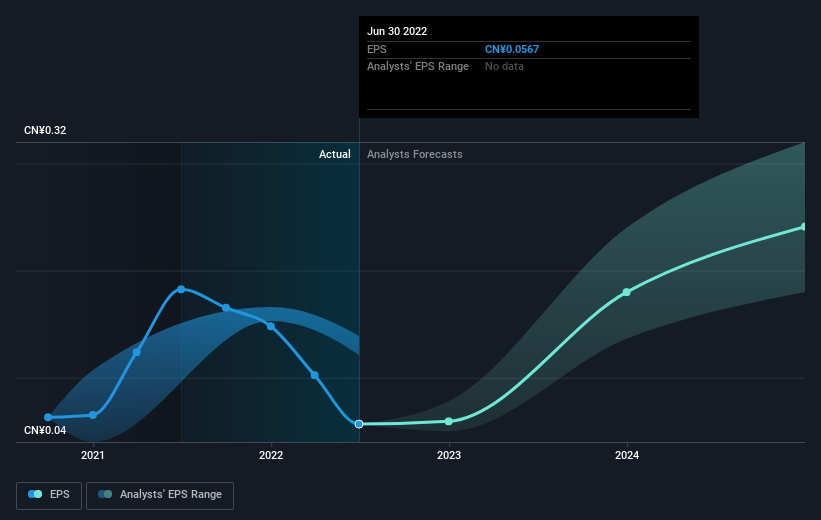

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Unhappily, Zhou Hei Ya International Holdings had to report a 69% decline in EPS over the last year. The share price fall of 47% isn't as bad as the reduction in earnings per share. It may have been that the weak EPS was not as bad as some had feared. With a P/E ratio of 67.22, it's fair to say the market sees an EPS rebound on the cards.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

SEHK:1458 Earnings Per Share Growth September 29th 2022

SEHK:1458 Earnings Per Share Growth September 29th 2022It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

We regret to report that Zhou Hei Ya International Holdings shareholders are down 46% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 23%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Zhou Hei Ya International Holdings has 1 warning sign we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.