The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. For instance the Revance Therapeutics, Inc. (NASDAQ:RVNC) share price is 100% higher than it was three years ago. Most would be happy with that. It's also good to see the share price up 73% over the last quarter.

While the stock has fallen 5.6% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

View our latest analysis for Revance Therapeutics

Given that Revance Therapeutics didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 3 years Revance Therapeutics saw its revenue grow at 109% per year. That's well above most pre-profit companies. Meanwhile, the share price performance has been pretty solid at 26% compound over three years. But it does seem like the market is paying attention to strong revenue growth. That's not to say we think the share price is too high. In fact, it might be worth keeping an eye on this one.

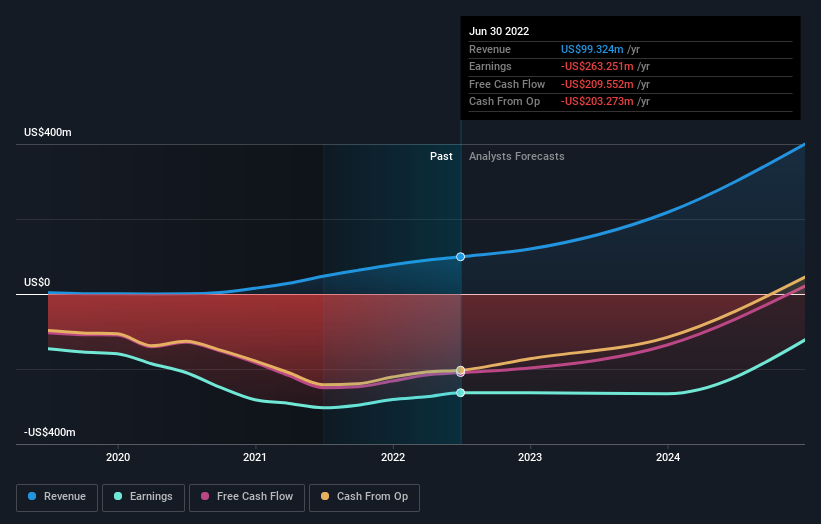

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

NasdaqGM:RVNC Earnings and Revenue Growth September 28th 2022

NasdaqGM:RVNC Earnings and Revenue Growth September 28th 2022We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

While it's never nice to take a loss, Revance Therapeutics shareholders can take comfort that their trailing twelve month loss of 14% wasn't as bad as the market loss of around 21%. Unfortunately, last year's performance may indicate unresolved challenges, given that it's worse than the annualised loss of 2% over the last half decade. While some investors do well specializing in buying companies that are struggling (but nonetheless undervalued), don't forget that Buffett said that 'turnarounds seldom turn'. It's always interesting to track share price performance over the longer term. But to understand Revance Therapeutics better, we need to consider many other factors. Even so, be aware that Revance Therapeutics is showing 4 warning signs in our investment analysis , and 1 of those is significant...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.