Investing in stocks inevitably means buying into some companies that perform poorly. But the last three years have been particularly tough on longer term Compañía de Minas Buenaventura S.A.A. (NYSE:BVN) shareholders. Unfortunately, they have held through a 61% decline in the share price in that time. The falls have accelerated recently, with the share price down 15% in the last three months.

After losing 8.6% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Compañía de Minas BuenaventuraA

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Compañía de Minas BuenaventuraA became profitable within the last five years. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

With a rather small yield of just 1.2% we doubt that the stock's share price is based on its dividend. The company has kept revenue pretty healthy over the last three years, so we doubt that explains the falling share price. There doesn't seem to be any clear correlation between the fundamental business metrics and the share price. That could mean that the stock was previously overrated, or it could spell opportunity now.

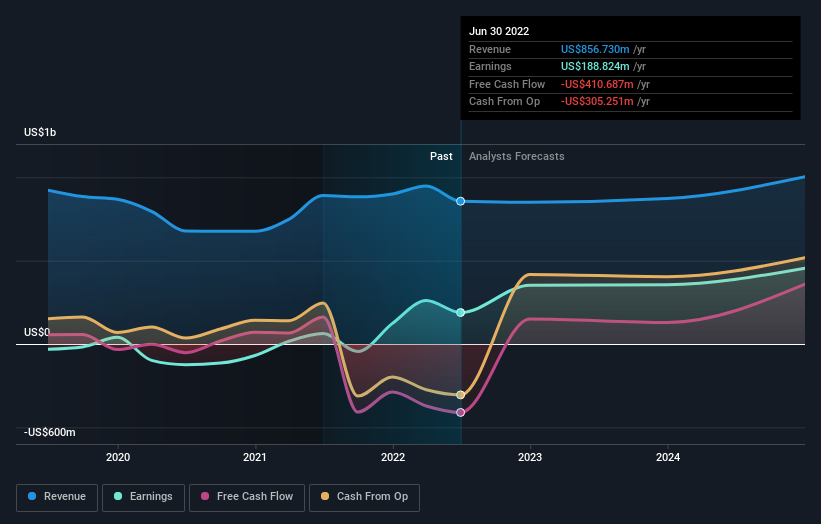

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

NYSE:BVN Earnings and Revenue Growth September 27th 2022

NYSE:BVN Earnings and Revenue Growth September 27th 2022It is of course excellent to see how Compañía de Minas BuenaventuraA has grown profits over the years, but the future is more important for shareholders. This free interactive report on Compañía de Minas BuenaventuraA's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While it's certainly disappointing to see that Compañía de Minas BuenaventuraA shares lost 19% throughout the year, that wasn't as bad as the market loss of 23%. Given the total loss of 9% per year over five years, it seems returns have deteriorated in the last twelve months. Whilst Baron Rothschild does tell the investor "buy when there's blood in the streets, even if the blood is your own", buyers would need to examine the data carefully to be comfortable that the business itself is sound. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for Compañía de Minas BuenaventuraA that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.