Shares of Canadian tech information management company Open Text (TSE: OTEX) (NASDAQ: OTEX) have been tanking lately. What sparked an even more rapid sell-off recently was its August 25th announcement that it will acquire Micro Focus International (LSE: MCRO) for ~$6 billion. Shares fell about 14% following this announcement and have been falling ever since. With the stock substantially off its all-time highs now and with a ‘Perfect 10’ Smart Score rating, however, OTEX stock is worth considering.

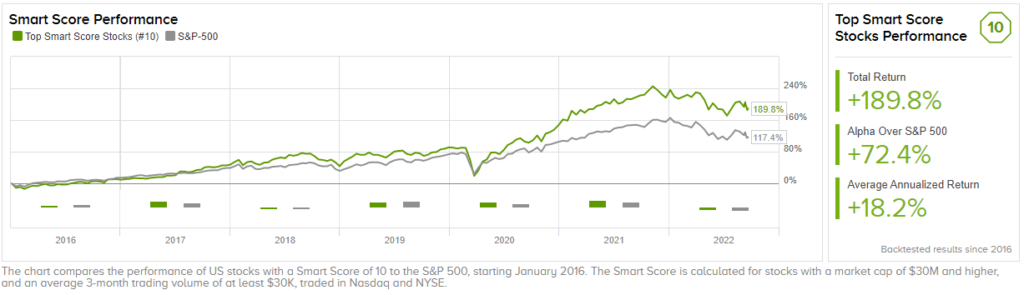

Worth noting, stocks with perfect Smart Score ratings have historically outperformed the S&P 500 (SPX), as shown in the image below.

What Makes Open Text Stock Intriguing?

Here’s what makes OTEX stock interesting, whether you like the company or not. It’s a high-margin, profitable tech stock with modest growth that is trading at “value-stock” levels (8.1x forward earnings, to be exact). Its revenue has grown at a CAGR of 8.8% in the past five years, and revenue growth is still expected to be in the mid-to-high single-digit range for the next two years.

Also, the company’s gross margins have steadily trended higher over the past decade, going from 71.2% in Fiscal 2013 to 75.3% in Fiscal 2022 – a sign that competitors aren’t chipping away at profits.

Open Text’s Valuation Looks Cheap

As mentioned before, OTEX stock is trading at about 8.1x forward earnings for Fiscal 2023 (which ends June 2023). This is based on EPS estimates of $3.34 for the year. The following year, EPS is expected to grow by over 10%, bringing the multiple down to 7.3x. This is undoubtedly cheap.

Note: All figures are in U.S. Dollars unless otherwise stated.

However, we shouldn’t just stop at earnings. Free cash flow is arguably a more important metric. Based on estimates from just three analysts, OTEX’s free cash flow is expected to come in at $935 million in Fiscal 2023. With a market cap of about $7.2 billion, this implies a 7.7x price/FCF multiple. Based on these numbers alone, along with the company’s long-term growth trajectory, OTEX can provide lots of value to investors.

Open Text’s High Debt is Something to Consider

While OTEX stock looks cheap based on what we mentioned above, the company also has a fairly large amount of debt, which may be weighing on its valuation multiple. Compared to its cash position of $1.7 billion, the company’s debt sits at $4.22 billion, giving it a net debt position of $2.52 billion (over a third of its market cap).

However, its debt position is about to get larger. The Micro Focus acquisition announcement states, “We intend to fund the all-cash Acquisition with existing cash, new debt, and our existing revolving credit facility.”

Since the acquisition is worth approximately $6 billion and the company only had about $1.7 billion in cash, you can expect a few extra billion dollars in debt. This may be partially why investors didn’t like the acquisition announcement. Nonetheless, OTEX is highly profitable, and its debt is currently manageable.

Is Open Text Stock a Buy, According to Analysts?

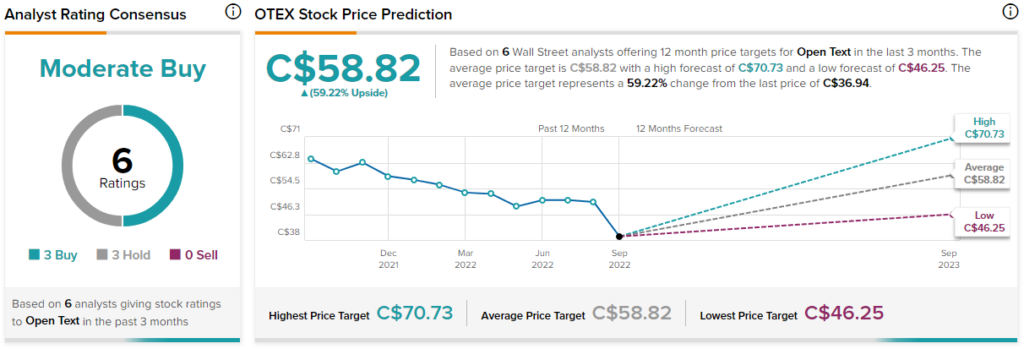

According to analysts, Open Text stock earns a Moderate Buy consensus rating based on three Buys and three Holds assigned in the past three months. The average OTEX stock price forecast of C$58.82 implies 59.2% upside potential. Analyst price targets range from a high of C$70.73 to a low of C$46.25.

Conclusion: OTEX is a Cheap Stock Worth Considering

While OTEX has a decent chunk of debt on its balance sheet, it’s hard not to see the value here based on analyst estimates. This may be why analysts see 59.2% upside potential and why it has a ‘Perfect 10’ Smart Score rating. Not many tech stocks are trading this “cheaply.” If you can get past its recent acquisition and high debt, then OTEX is a solid stock to consider for the long term.