Halma (GB:HLMA) owns a group of small and mid-sized companies delivering life-saving technology and innovative solutions in sectors such as healthcare, safety, and the environment – but the company’s stock is also highly attractive for dividend investors.

The company has a unique business model and operates in a niche market with less competition. This gives it an edge and makes it fit for long-term investment.

The company’s stock has been on a roller coaster ride in the last year. After hitting a high point by the end of 2021, the stock tumbled and has been trading down by 34% this year. After the company reported its annual results, the share prices gained some momentum again.

Stronger outlook

In its full-year results for 2022, the company posted a jump of 16% in revenues. This was the first time the company reached £1.5 billion in revenues. Also, this was the company’s 19th consecutive year to post a growth in profits. Pre-tax profits increased by 14% to £316.2 million. Almost 80% of the companies under Halma delivered double-digit revenue growth.

The company has entered a new financial year with a strong order book and expects to continue revenue growth. The company also has a good pipeline for more acquisitions this year.

Last week, the company posted a trading update and reiterated its full-year guidance numbers based on higher demand for its products and services. The guidance remains unchanged, with single-digit percentage revenue growth expected.

Impressive dividends

Solid cash generation is an important aspect of Halma’s business model, helping the company deliver healthy returns to its shareholders.

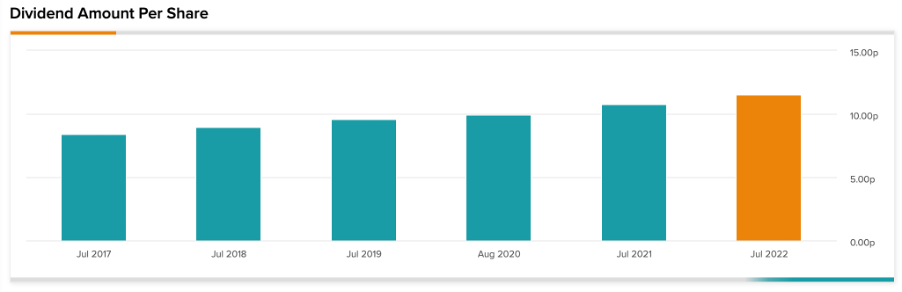

The company has been a consistent dividend payer for many years. In 2022, the company increased its dividend by 7% to 18.8p per share.

This was the company’s 43rd consecutive year to increase its dividends by 5% or more. This makes it a dividend gem for income investors.

Halma share price forecast

According to TipRanks consensus, Halma stock has a Hold rating, based on a total of six recommendations.

The HLMA target price is 2,193.0p, which is 4.2% higher than the current price level. The target price has a high forecast of 2,410p and a low forecast of 1,820p.

Conclusion

Halma has a highly specialised portfolio of companies, which are mostly delivering solid revenue growth. It has the scope to grow into a huge technology company, with the advantages of the healthcare and environmental sectors.

Considering the company’s growth potential and dividend-paying history, Halma stock is a great choice for income investors looking for growth over the long haul.