It's not a secret that every investor will make bad investments, from time to time. But it would be foolish to simply accept every extremely large loss as an inevitable part of the game. We wouldn't blame StoneCo Ltd. (NASDAQ:STNE) shareholders if they were still in shock after the stock dropped like a lead balloon, down 77% in just one year. A loss like this is a stark reminder that portfolio diversification is important. Notably, shareholders had a tough run over the longer term, too, with a drop of 73% in the last three years.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

Check out our latest analysis for StoneCo

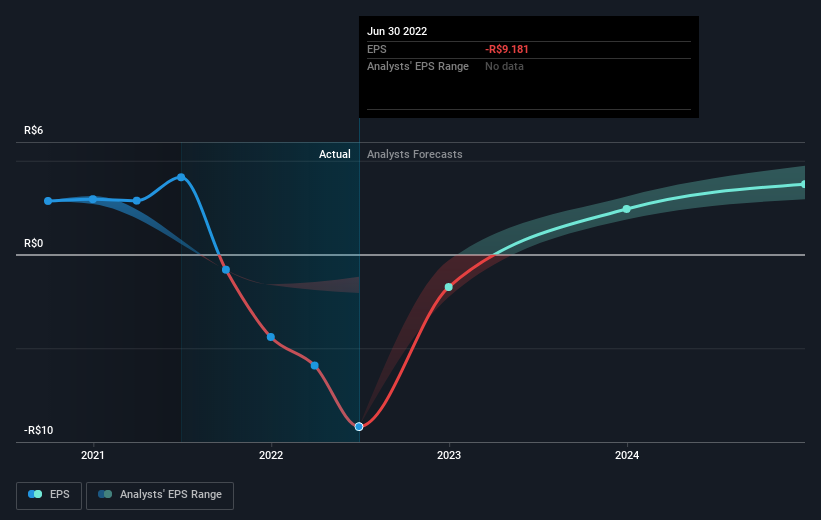

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

StoneCo fell to a loss making position during the year. While this may prove temporary, we'd consider it a negative, so it doesn't surprise us that the stock price is down. However, there may be an opportunity for investors if the company can recover.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

NasdaqGS:STNE Earnings Per Share Growth September 26th 2022

NasdaqGS:STNE Earnings Per Share Growth September 26th 2022It might be well worthwhile taking a look at our free report on StoneCo's earnings, revenue and cash flow.

A Different Perspective

The last twelve months weren't great for StoneCo shares, which performed worse than the market, costing holders 77%. The market shed around 22%, no doubt weighing on the stock price. Shareholders have lost 20% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - StoneCo has 1 warning sign we think you should be aware of.

But note: StoneCo may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.