Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that CACI International Inc (NYSE:CACI) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for CACI International

What Is CACI International's Debt?

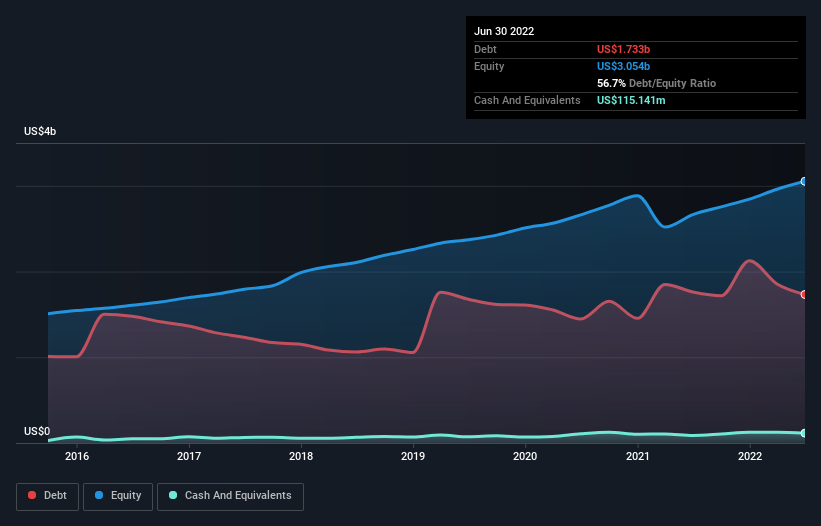

The chart below, which you can click on for greater detail, shows that CACI International had US$1.73b in debt in June 2022; about the same as the year before. However, it does have US$115.1m in cash offsetting this, leading to net debt of about US$1.62b.

NYSE:CACI Debt to Equity History September 26th 2022

NYSE:CACI Debt to Equity History September 26th 2022A Look At CACI International's Liabilities

Zooming in on the latest balance sheet data, we can see that CACI International had liabilities of US$1.03b due within 12 months and liabilities of US$2.55b due beyond that. On the other hand, it had cash of US$115.1m and US$926.1m worth of receivables due within a year. So it has liabilities totalling US$2.53b more than its cash and near-term receivables, combined.

While this might seem like a lot, it is not so bad since CACI International has a market capitalization of US$6.36b, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

CACI International has a debt to EBITDA ratio of 2.6, which signals significant debt, but is still pretty reasonable for most types of business. But its EBIT was about 11.9 times its interest expense, implying the company isn't really paying a high cost to maintain that level of debt. Even were the low cost to prove unsustainable, that is a good sign. Unfortunately, CACI International saw its EBIT slide 8.0% in the last twelve months. If earnings continue on that decline then managing that debt will be difficult like delivering hot soup on a unicycle. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine CACI International's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, CACI International actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

Both CACI International's ability to to convert EBIT to free cash flow and its interest cover gave us comfort that it can handle its debt. Having said that, its EBIT growth rate somewhat sensitizes us to potential future risks to the balance sheet. When we consider all the elements mentioned above, it seems to us that CACI International is managing its debt quite well. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 2 warning signs with CACI International , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.