To the annoyance of some shareholders, Viva Biotech Holdings (HKG:1873) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 77% loss during that time.

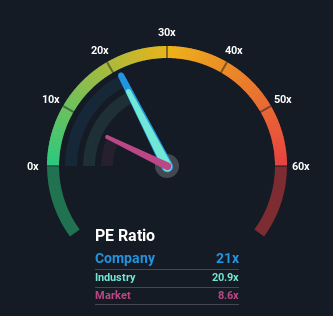

In spite of the heavy fall in price, given close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 8x, you may still consider Viva Biotech Holdings as a stock to avoid entirely with its 21x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings that are retreating more than the market's of late, Viva Biotech Holdings has been very sluggish. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

Check out our latest analysis for Viva Biotech Holdings

SEHK:1873 Price Based on Past Earnings September 25th 2022 Want the full picture on analyst estimates for the company? Then our free report on Viva Biotech Holdings will help you uncover what's on the horizon.

SEHK:1873 Price Based on Past Earnings September 25th 2022 Want the full picture on analyst estimates for the company? Then our free report on Viva Biotech Holdings will help you uncover what's on the horizon. How Is Viva Biotech Holdings' Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Viva Biotech Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 53% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 22% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 98% per year during the coming three years according to the only analyst following the company. With the market only predicted to deliver 14% per year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Viva Biotech Holdings' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Even after such a strong price drop, Viva Biotech Holdings' P/E still exceeds the rest of the market significantly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Viva Biotech Holdings' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 2 warning signs for Viva Biotech Holdings (1 is a bit unpleasant!) that we have uncovered.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a P/E below 20x.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.