It's been a soft week for Mersana Therapeutics, Inc. (NASDAQ:MRSN) shares, which are down 13%. But over the last three years the stock has shone bright like a diamond. Indeed, the share price is up a whopping 317% in that time. As long term investors the recent fall doesn't detract all that much from the longer term story. The share price action could signify that the business itself is dramatically improved, in that time.

Although Mersana Therapeutics has shed US$95m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for Mersana Therapeutics

Mersana Therapeutics wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 3 years Mersana Therapeutics saw its revenue shrink by 121% per year. This is in stark contrast to the strong share price growth of 61%, compound, per year. This clear lack of correlation between revenue and share price is surprising to see in a money losing company. At the risk of upsetting holders, this does suggest that hope for a better future is playing a significant role in the share price action.

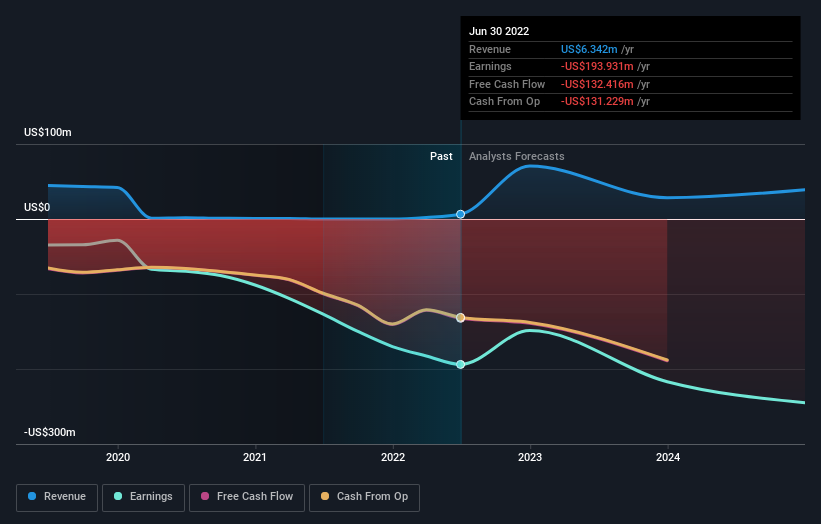

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

NasdaqGS:MRSN Earnings and Revenue Growth September 22nd 2022

NasdaqGS:MRSN Earnings and Revenue Growth September 22nd 2022Take a more thorough look at Mersana Therapeutics' financial health with this free report on its balance sheet.

A Different Perspective

We regret to report that Mersana Therapeutics shareholders are down 29% for the year. Unfortunately, that's worse than the broader market decline of 19%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 3 warning signs we've spotted with Mersana Therapeutics .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.