While it may not be enough for some shareholders, we think it is good to see the Freshworks Inc. (NASDAQ:FRSH) share price up 17% in a single quarter. But that hardly compensates for the shocking decline over the last twelve months. During that time the share price has plummeted like a stone, down 70%. So it's not that amazing to see a bit of a bounce. The important thing is whether the company can turn it around, longer term.

With the stock having lost 11% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for Freshworks

Freshworks wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year Freshworks saw its revenue grow by 42%. That's definitely a respectable growth rate. Unfortunately, the market wanted something better, given it sent the share price 70% lower during the year. One fear might be that the company might be losing too much money and will need to raise more. We'd posit that the future looks challenging, given the disconnect between revenue growth and the share price.

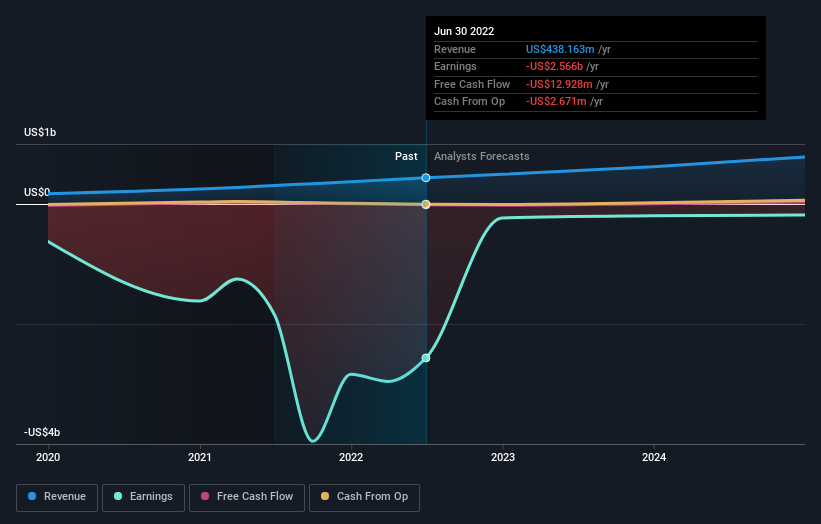

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

NasdaqGS:FRSH Earnings and Revenue Growth September 22nd 2022

NasdaqGS:FRSH Earnings and Revenue Growth September 22nd 2022Freshworks is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

Freshworks shareholders are down 70% for the year, even worse than the market loss of 19%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. It's great to see a nice little 17% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). It's always interesting to track share price performance over the longer term. But to understand Freshworks better, we need to consider many other factors. For example, we've discovered 1 warning sign for Freshworks that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.