It's been a soft week for Shanghai Emperor of Cleaning Hi-Tech Co., Ltd (SHSE:603200) shares, which are down 12%. On the other hand the share price is higher than it was three years ago. In that time, it is up 13%, which isn't bad, but not amazing either.

In light of the stock dropping 12% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive three-year return.

See our latest analysis for Shanghai Emperor of Cleaning Hi-Tech

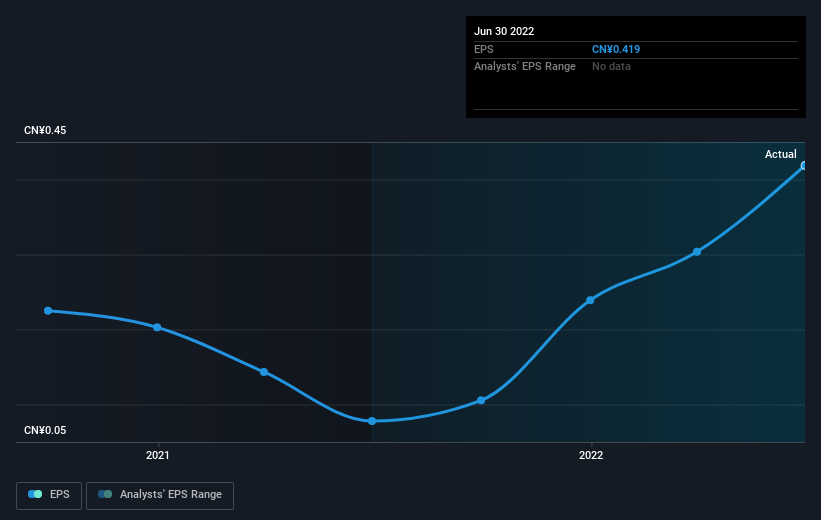

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over the last three years, Shanghai Emperor of Cleaning Hi-Tech failed to grow earnings per share, which fell 1.4% (annualized).

The comparison of the modestly falling earnings per share, and the relatively resilient share price, suggests the market is less cautious about the stock, these days. Ultimately, though, we don't think it can maintain share price gains without turning around the EPS growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

SHSE:603200 Earnings Per Share Growth September 21st 2022

SHSE:603200 Earnings Per Share Growth September 21st 2022This free interactive report on Shanghai Emperor of Cleaning Hi-Tech's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Shanghai Emperor of Cleaning Hi-Tech shareholders have received a total shareholder return of 13% over one year. And that does include the dividend. That certainly beats the loss of about 1.1% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Shanghai Emperor of Cleaning Hi-Tech is showing 1 warning sign in our investment analysis , you should know about...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CN exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.