It is a pleasure to report that the Phreesia, Inc. (NYSE:PHR) is up 30% in the last quarter. But that's not enough to compensate for the decline over the last twelve months. During that time the share price has sank like a stone, descending 57%. It's not that amazing to see a bounce after a drop like that. You could argue that the sell-off was too severe.

If the past week is anything to go by, investor sentiment for Phreesia isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for Phreesia

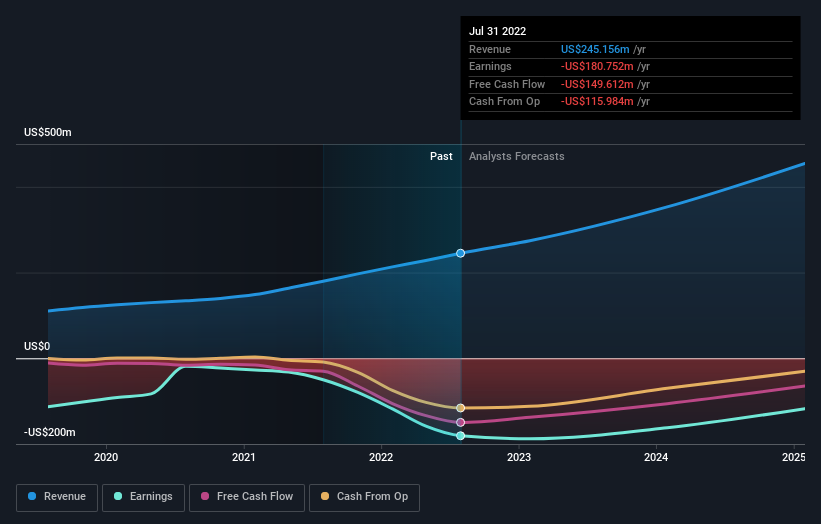

Because Phreesia made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last twelve months, Phreesia increased its revenue by 37%. That's definitely a respectable growth rate. Meanwhile, the share price tanked 57%, suggesting the market had much higher expectations. It may well be that the business remains approximately on track, but its revenue growth has simply been delayed. For us it's important to consider when you think a company will become profitable, if you're basing your valuation on revenue.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

NYSE:PHR Earnings and Revenue Growth September 20th 2022

NYSE:PHR Earnings and Revenue Growth September 20th 2022Phreesia is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Phreesia shareholders are down 57% for the year, falling short of the market return. The market shed around 15%, no doubt weighing on the stock price. The three-year loss of 0.9% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Phreesia , and understanding them should be part of your investment process.

But note: Phreesia may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.