The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But if you buy shares in a really great company, you can more than double your money. To wit, the Binjiang Service Group Co. Ltd. (HKG:3316) share price has flown 208% in the last three years. That sort of return is as solid as granite. And in the last month, the share price has gained 8.9%. This could be related to the recent financial results that were recently released - you could check the most recent data by reading our company report.

While this past week has detracted from the company's three-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

View our latest analysis for Binjiang Service Group

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

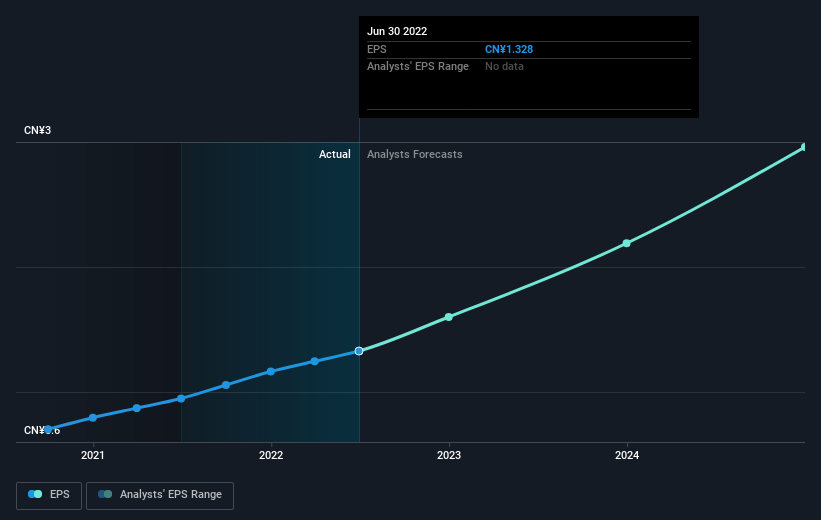

During three years of share price growth, Binjiang Service Group achieved compound earnings per share growth of 52% per year. We don't think it is entirely coincidental that the EPS growth is reasonably close to the 45% average annual increase in the share price. That suggests that the market sentiment around the company hasn't changed much over that time. Au contraire, the share price change has arguably mimicked the EPS growth.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

SEHK:3316 Earnings Per Share Growth September 20th 2022

SEHK:3316 Earnings Per Share Growth September 20th 2022We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on Binjiang Service Group's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Binjiang Service Group's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Binjiang Service Group's TSR of 234% for the 3 years exceeded its share price return, because it has paid dividends.

A Different Perspective

We're pleased to report that Binjiang Service Group rewarded shareholders with a total shareholder return of 15% over the last year. That falls short of the 49% it has made, for shareholders, each year, over three years. Before forming an opinion on Binjiang Service Group you might want to consider these 3 valuation metrics.

Of course Binjiang Service Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.