TriNet Group, Inc. (NYSE:TNET) shareholders have seen the share price descend 15% over the month. But in stark contrast, the returns over the last half decade have impressed. We think most investors would be happy with the 130% return, over that period. Generally speaking the long term returns will give you a better idea of business quality than short periods can. The more important question is whether the stock is too cheap or too expensive today.

Since the long term performance has been good but there's been a recent pullback of 7.1%, let's check if the fundamentals match the share price.

View our latest analysis for TriNet Group

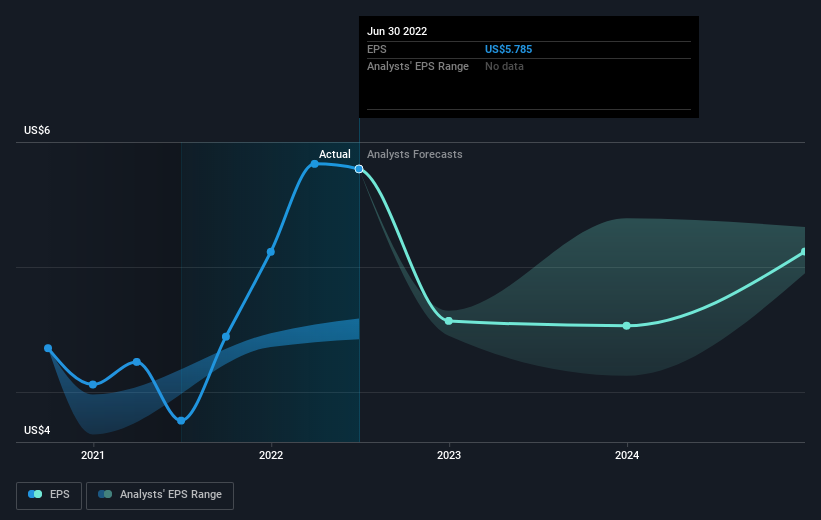

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over half a decade, TriNet Group managed to grow its earnings per share at 32% a year. The EPS growth is more impressive than the yearly share price gain of 18% over the same period. So it seems the market isn't so enthusiastic about the stock these days.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

NYSE:TNET Earnings Per Share Growth September 19th 2022

NYSE:TNET Earnings Per Share Growth September 19th 2022We know that TriNet Group has improved its bottom line over the last three years, but what does the future have in store? You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

The total return of 18% received by TriNet Group shareholders over the last year isn't far from the market return of -17%. The silver lining is that longer term investors would have made a total return of 18% per year over half a decade. If the fundamental data remains strong, and the share price is simply down on sentiment, then this could be an opportunity worth investigating. Before spending more time on TriNet Group it might be wise to click here to see if insiders have been buying or selling shares.

We will like TriNet Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.