Even the best investor on earth makes unsuccessful investments. But it's not unreasonable to try to avoid truly shocking capital losses. It must have been painful to be a CanSino Biologics Inc. (HKG:6185) shareholder over the last year, since the stock price plummeted 79% in that time. That'd be enough to make even the strongest stomachs churn. On the other hand, the stock is actually up 59% over three years. Shareholders have had an even rougher run lately, with the share price down 25% in the last 90 days. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

On a more encouraging note the company has added CN¥938m to its market cap in just the last 7 days, so let's see if we can determine what's driven the one-year loss for shareholders.

See our latest analysis for CanSino Biologics

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Even though the CanSino Biologics share price is down over the year, its EPS actually improved. Of course, the situation might betray previous over-optimism about growth.

The divergence between the EPS and the share price is quite notable, during the year. So it's well worth checking out some other metrics, too.

With a low yield of 1.6% we doubt that the dividend influences the share price much. CanSino Biologics managed to grow revenue over the last year, which is usually a real positive. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

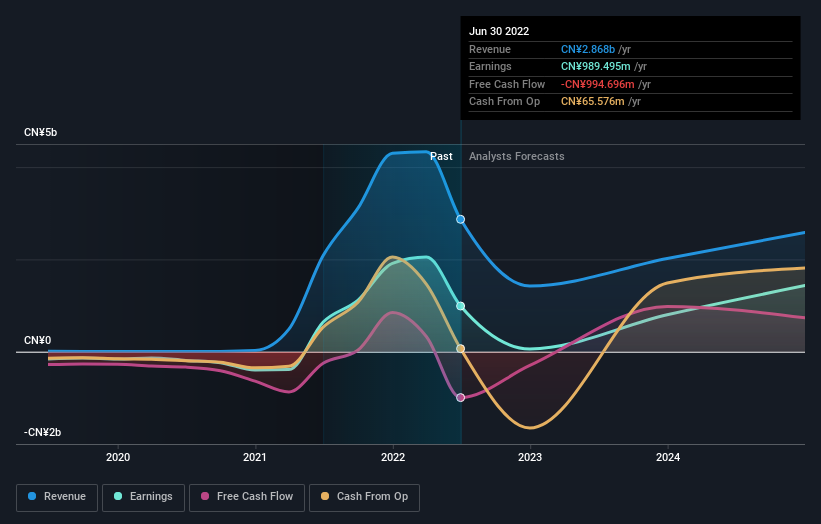

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

SEHK:6185 Earnings and Revenue Growth September 15th 2022

SEHK:6185 Earnings and Revenue Growth September 15th 2022It is of course excellent to see how CanSino Biologics has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling CanSino Biologics stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

CanSino Biologics shareholders are down 79% for the year (even including dividends), falling short of the market return. Meanwhile, the broader market slid about 21%, likely weighing on the stock. Investors are up over three years, booking 17% per year, much better than the more recent returns. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 1 warning sign for CanSino Biologics you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.