Long term investing is the way to go, but that doesn't mean you should hold every stock forever. We really hate to see fellow investors lose their hard-earned money. Spare a thought for those who held MGM China Holdings Limited (HKG:2282) for five whole years - as the share price tanked 77%. And some of the more recent buyers are probably worried, too, with the stock falling 46% in the last year. On the other hand the share price has bounced 7.3% over the last week. We would posit that the recently released financial results have driven this rise, so you might want to check the latest numbers in our full company report.

The recent uptick of 7.3% could be a positive sign of things to come, so let's take a lot at historical fundamentals.

View our latest analysis for MGM China Holdings

MGM China Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last five years MGM China Holdings saw its revenue shrink by 16% per year. That's definitely a weaker result than most pre-profit companies report. So it's not that strange that the share price dropped 12% per year in that period. This kind of price performance makes us very wary, especially when combined with falling revenue. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

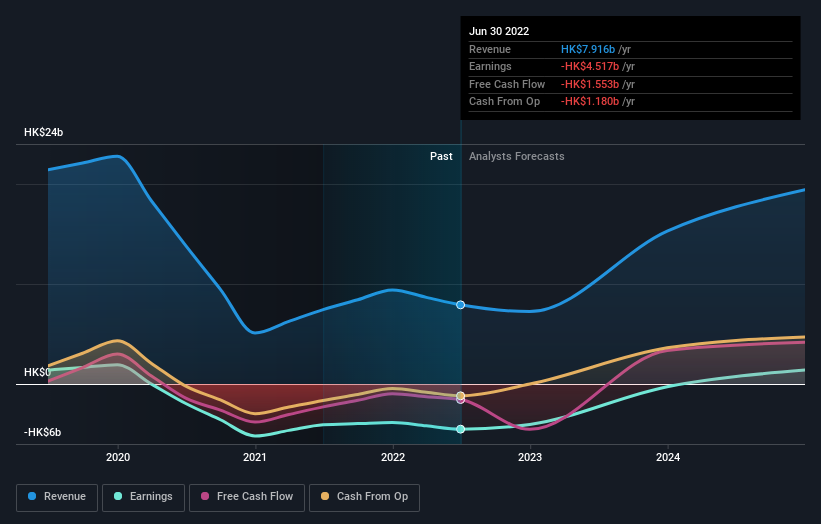

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

SEHK:2282 Earnings and Revenue Growth September 13th 2022

SEHK:2282 Earnings and Revenue Growth September 13th 2022MGM China Holdings is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think MGM China Holdings will earn in the future (free analyst consensus estimates)

A Different Perspective

We regret to report that MGM China Holdings shareholders are down 46% for the year. Unfortunately, that's worse than the broader market decline of 22%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 12% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with MGM China Holdings , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.