Shareholders will be pleased by the robust performance of IBO Technology Company Limited (HKG:2708) recently and this will be kept in mind in the upcoming AGM on 20 September 2022. This would also be a chance for them to hear the board review the financial results, discuss future company strategy to further improve the business and vote on any resolutions such as executive remuneration. We have prepared some analysis below and we show why we think CEO compensation looks decent with even the possibility for a raise.

Check out our latest analysis for IBO Technology

Comparing IBO Technology Company Limited's CEO Compensation With The Industry

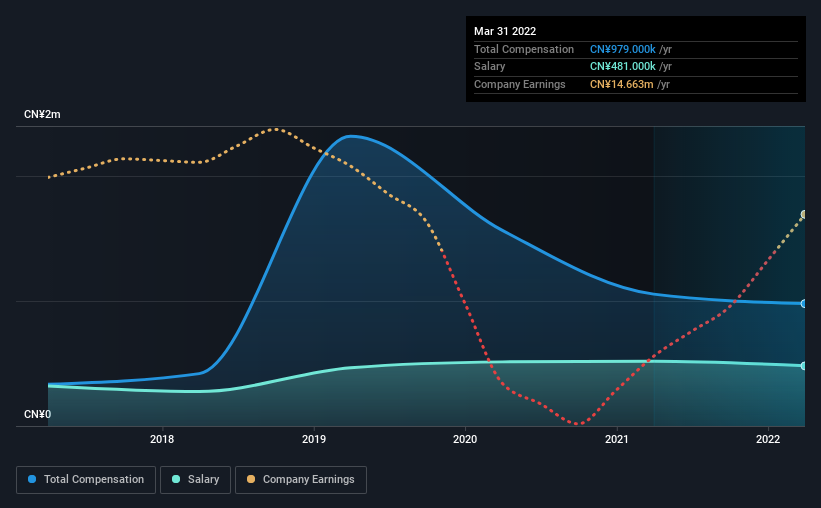

At the time of writing, our data shows that IBO Technology Company Limited has a market capitalization of HK$1.2b, and reported total annual CEO compensation of CN¥979k for the year to March 2017. Notably, that's an increase of 134% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at CN¥481k.

On comparing similar-sized companies in the industry with market capitalizations below HK$1.6b, we found that the median total CEO compensation was CN¥2.0m. Accordingly, IBO Technology pays its CEO under the industry median.

| Component | 2017 | 2018 | Proportion (2017) |

| Salary | CN¥481k | CN¥276k | 49% |

| Other | CN¥498k | CN¥143k | 51% |

| Total Compensation | CN¥979k | CN¥419k | 100% |

Talking in terms of the industry, salary represented approximately 74% of total compensation out of all the companies we analyzed, while other remuneration made up 26% of the pie. IBO Technology sets aside a smaller share of compensation for salary, in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

SEHK:2708 CEO Compensation September 13th 2022

SEHK:2708 CEO Compensation September 13th 2022IBO Technology Company Limited's Growth

Over the last three years, IBO Technology Company Limited has shrunk its earnings per share by 35% per year. Its revenue is up 87% over the last year.

The decrease in EPS could be a concern for some investors. But on the other hand, revenue growth is strong, suggesting a brighter future. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has IBO Technology Company Limited Been A Good Investment?

IBO Technology Company Limited has served shareholders reasonably well, with a total return of 14% over three years. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

In Summary...

The company's overall performance, while not bad, could be better. If it continues on the same road, shareholders might feel even more confident about their investment, and have little to no objections concerning CEO pay. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 3 warning signs for IBO Technology (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.