It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like China Pioneer Pharma Holdings (HKG:1345). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for China Pioneer Pharma Holdings

How Fast Is China Pioneer Pharma Holdings Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That makes EPS growth an attractive quality for any company. To the delight of shareholders, China Pioneer Pharma Holdings has achieved impressive annual EPS growth of 48%, compound, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

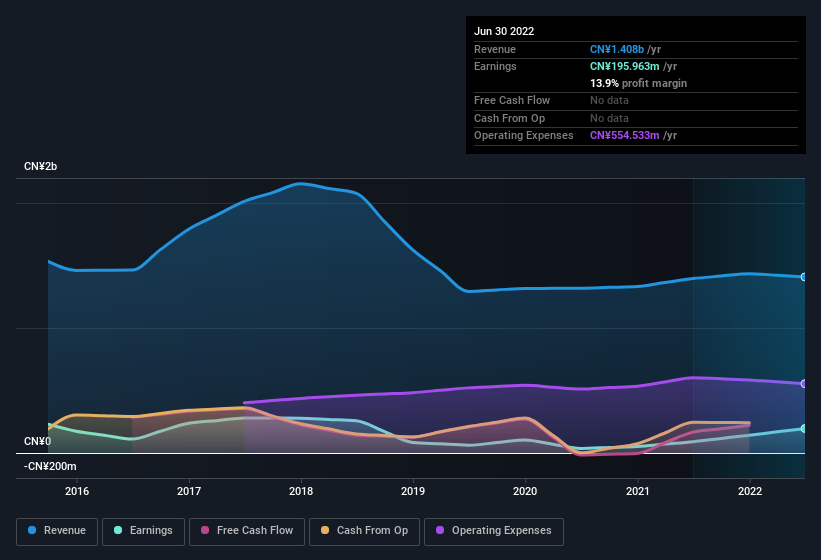

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While revenue is looking a bit flat, the good news is EBIT margins improved by 4.4 percentage points to 14%, in the last twelve months. That's something to smile about.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

SEHK:1345 Earnings and Revenue History September 9th 2022

SEHK:1345 Earnings and Revenue History September 9th 2022While profitability drives the upside, prudent investors always check the balance sheet, too.

Are China Pioneer Pharma Holdings Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. The median total compensation for CEOs of companies similar in size to China Pioneer Pharma Holdings, with market caps between CN¥1.4b and CN¥5.6b, is around CN¥2.9m.

China Pioneer Pharma Holdings' CEO took home a total compensation package of CN¥556k in the year prior to December 2021. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Does China Pioneer Pharma Holdings Deserve A Spot On Your Watchlist?

China Pioneer Pharma Holdings' earnings per share have been soaring, with growth rates sky high. With increasing profits, its seems likely the business has a rosy future; and it may have hit an inflection point. What's more, the fact that the CEO's compensation is quite reasonable is a sign that the company is conscious of excessive spending. It will definitely require further research to be sure, but it does seem that China Pioneer Pharma Holdings has the hallmarks of a quality business; and that would make it well worth watching. We should say that we've discovered 2 warning signs for China Pioneer Pharma Holdings (1 is significant!) that you should be aware of before investing here.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.