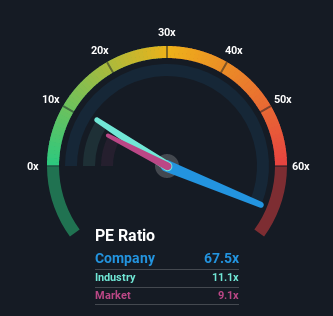

With a price-to-earnings (or "P/E") ratio of 67.5x Space Group Holdings Limited (HKG:2448) may be sending very bearish signals at the moment, given that almost half of all companies in Hong Kong have P/E ratios under 9x and even P/E's lower than 4x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

As an illustration, earnings have deteriorated at Space Group Holdings over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

Check out our latest analysis for Space Group Holdings

SEHK:2448 Price Based on Past Earnings September 6th 2022 We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Space Group Holdings' earnings, revenue and cash flow.

SEHK:2448 Price Based on Past Earnings September 6th 2022 We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Space Group Holdings' earnings, revenue and cash flow. What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Space Group Holdings' is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 19% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 39% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 22% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's alarming that Space Group Holdings' P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Space Group Holdings revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Space Group Holdings, and understanding them should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E's below 20x.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.