GCL New Energy Holdings Limited (HKG:451) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. The revenue forecast for this year has experienced a facelift, with analysts now much more optimistic on its sales pipeline.

Following the latest upgrade, the dual analysts covering GCL New Energy Holdings provided consensus estimates of CN¥1.1b revenue in 2022, which would reflect a sizeable 25% decline on its sales over the past 12 months. Losses are predicted to fall substantially, shrinking 73% to CN¥0.016. However, before this estimates update, the consensus had been expecting revenues of CN¥792m and CN¥0.00047 per share in losses. Ergo, there's been a clear change in sentiment, with the analysts lifting this year's revenue estimates, while at the same time increasing their loss per share forecasts to reflect the cost of achieving this growth.

See our latest analysis for GCL New Energy Holdings

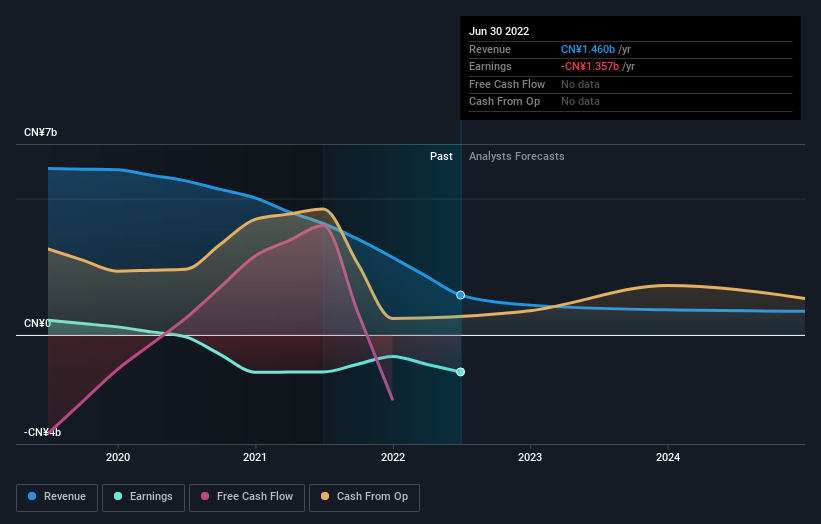

SEHK:451 Earnings and Revenue Growth September 6th 2022

SEHK:451 Earnings and Revenue Growth September 6th 2022It will come as no surprise that expanding losses caused the consensus price target to fall 26% to CN¥0.11 with the analysts implicitly ranking ongoing losses as a greater concern than growing revenues. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic GCL New Energy Holdings analyst has a price target of CN¥0.15 per share, while the most pessimistic values it at CN¥0.10. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the GCL New Energy Holdings' past performance and to peers in the same industry. Over the past five years, revenues have declined around 8.5% annually. Worse, forecasts are essentially predicting the decline to accelerate, with the estimate for an annualised 25% decline in revenue until the end of 2022. Compare this against analyst estimates for companies in the broader industry, which suggest that revenues (in aggregate) are expected to grow 5.1% annually. So it's pretty clear that, while it does have declining revenues, the analysts also expect GCL New Energy Holdings to suffer worse than the wider industry.

The Bottom Line

The most important thing to take away is that analysts increased their loss per share estimates for this year. Pleasantly, analysts also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow slower than the wider market. The consensus price target fell measurably, with analysts seemingly not reassured by recent business developments, leading to a lower estimate of GCL New Energy Holdings' future valuation. Given that analysts appear to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at GCL New Energy Holdings.

Analysts are clearly in love with GCL New Energy Holdings at the moment, but before diving in - you should be aware that we've identified some warning flags with the business, such as a short cash runway. For more information, you can click through to our platform to learn more about this and the 1 other concern we've identified .

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.