Imperium Technology Group Limited (HKG:776) shareholders might be concerned after seeing the share price drop 16% in the last week. But over three years the performance has been really wonderful. Indeed, the share price is up a whopping 724% in that time. Arguably, the recent fall is to be expected after such a strong rise. The share price action could signify that the business itself is dramatically improved, in that time. Anyone who held for that rewarding ride would probably be keen to talk about it.

Although Imperium Technology Group has shed HK$778m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

View our latest analysis for Imperium Technology Group

Imperium Technology Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Imperium Technology Group actually saw its revenue drop by 16% per year over three years. So it's pretty amazing to see the stock price has zoomed up 102% per year in that time. There can be no doubt this kind of decoupling of revenue growth and share price growth is unusual to see in loss making companies. At the risk of upsetting holders, this does suggest that hope for a better future is playing a significant role in the share price action.

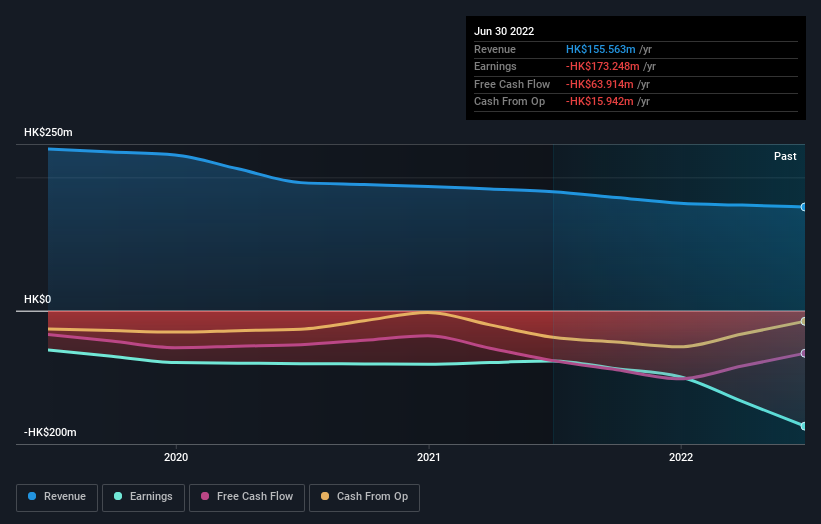

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

SEHK:776 Earnings and Revenue Growth September 6th 2022

SEHK:776 Earnings and Revenue Growth September 6th 2022This free interactive report on Imperium Technology Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Imperium Technology Group shareholders have received a total shareholder return of 14% over the last year. However, that falls short of the 31% TSR per annum it has made for shareholders, each year, over five years. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. It's always interesting to track share price performance over the longer term. But to understand Imperium Technology Group better, we need to consider many other factors. To that end, you should be aware of the 2 warning signs we've spotted with Imperium Technology Group .

We will like Imperium Technology Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.