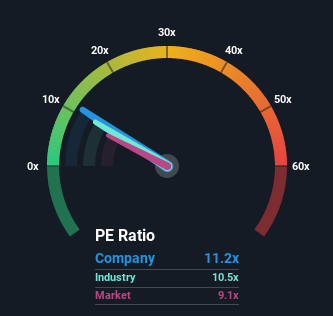

When close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 9x, you may consider Guolian Securities Co., Ltd. (HKG:1456) as a stock to potentially avoid with its 11.2x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Guolian Securities has been doing a good job lately as it's been growing earnings at a solid pace. One possibility is that the P/E is high because investors think this respectable earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Guolian Securities

SEHK:1456 Price Based on Past Earnings September 5th 2022 Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Guolian Securities will help you shine a light on its historical performance.

SEHK:1456 Price Based on Past Earnings September 5th 2022 Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Guolian Securities will help you shine a light on its historical performance. Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Guolian Securities' is when the company's growth is on track to outshine the market.

If we review the last year of earnings growth, the company posted a terrific increase of 26%. The latest three year period has also seen an excellent 133% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 22% shows it's noticeably more attractive on an annualised basis.

With this information, we can see why Guolian Securities is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Bottom Line On Guolian Securities' P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Guolian Securities maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for Guolian Securities (2 shouldn't be ignored!) that you should be aware of.

If these risks are making you reconsider your opinion on Guolian Securities, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.