We think that it's fair to say that the possibility of finding fantastic multi-year winners is what motivates many investors. Not every pick can be a winner, but when you pick the right stock, you can win big. One such superstar is Xinyi Electric Storage Holdings Limited (HKG:8328), which saw its share price soar 384% in three years. It's also good to see the share price up 45% over the last quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

Although Xinyi Electric Storage Holdings has shed HK$428m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for Xinyi Electric Storage Holdings

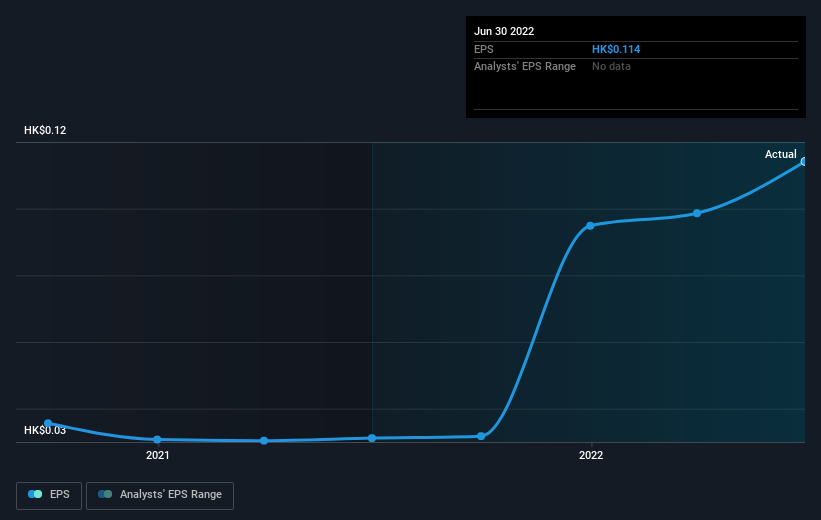

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Xinyi Electric Storage Holdings was able to grow its EPS at 7.2% per year over three years, sending the share price higher. In comparison, the 69% per year gain in the share price outpaces the EPS growth. So it's fair to assume the market has a higher opinion of the business than it did three years ago. That's not necessarily surprising considering the three-year track record of earnings growth. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 51.53.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

SEHK:8328 Earnings Per Share Growth September 2nd 2022

SEHK:8328 Earnings Per Share Growth September 2nd 2022It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Dive deeper into the earnings by checking this interactive graph of Xinyi Electric Storage Holdings' earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Xinyi Electric Storage Holdings' total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that Xinyi Electric Storage Holdings' TSR, at 399% is higher than its share price return of 384%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

While it's never nice to take a loss, Xinyi Electric Storage Holdings shareholders can take comfort that their trailing twelve month loss of 14% wasn't as bad as the market loss of around 19%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 32% for each year. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Xinyi Electric Storage Holdings (of which 1 is a bit unpleasant!) you should know about.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.