Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Unfortunately the Guangdong Fangyuan New Materials Group Co., Ltd. (SHSE:688148) share price slid 38% over twelve months. That's well below the market decline of 11%. Guangdong Fangyuan New Materials Group may have better days ahead, of course; we've only looked at a one year period. More recently, the share price has dropped a further 32% in a month. Importantly, this could be a market reaction to the recently released financial results. You can check out the latest numbers in our company report.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

View our latest analysis for Guangdong Fangyuan New Materials Group

We don't think that Guangdong Fangyuan New Materials Group's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Guangdong Fangyuan New Materials Group grew its revenue by 32% over the last year. We think that is pretty nice growth. Meanwhile, the share price is down 38% over twelve months, which is disappointing given the progress made. You might even wonder if the share price was previously over-hyped. But if revenue keeps growing, then at a certain point the share price would likely follow.

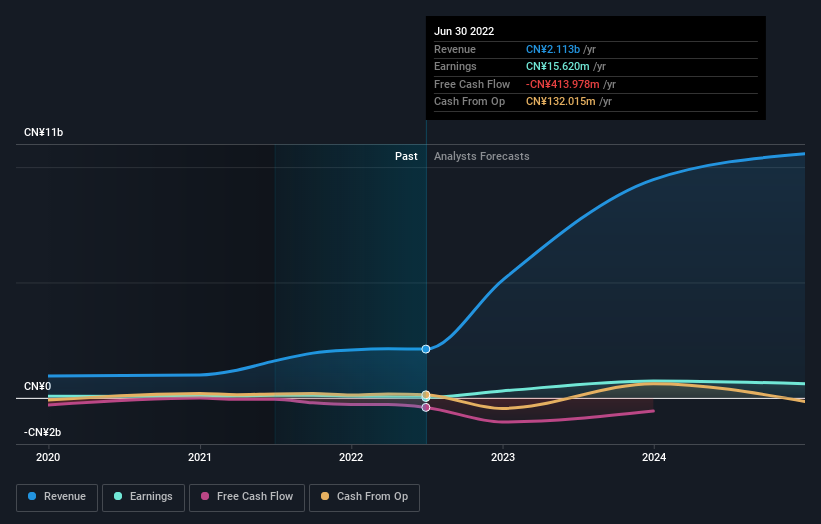

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

SHSE:688148 Earnings and Revenue Growth September 1st 2022

SHSE:688148 Earnings and Revenue Growth September 1st 2022Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Guangdong Fangyuan New Materials Group shareholders are down 37% for the year (even including dividends), even worse than the market loss of 11%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 4.6% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Guangdong Fangyuan New Materials Group (at least 3 which don't sit too well with us) , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CN exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.