The latest analyst coverage could presage a bad day for Archosaur Games Inc. (HKG:9990), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. Revenue estimates were cut sharply as the analysts signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well.

Following the downgrade, the current consensus from Archosaur Games' three analysts is for revenues of CN¥993m in 2022 which - if met - would reflect a sizeable 42% increase on its sales over the past 12 months. Prior to the latest estimates, the analysts were forecasting revenues of CN¥1.1b in 2022. It looks like forecasts have become a fair bit less optimistic on Archosaur Games, given the measurable cut to revenue estimates.

See our latest analysis for Archosaur Games

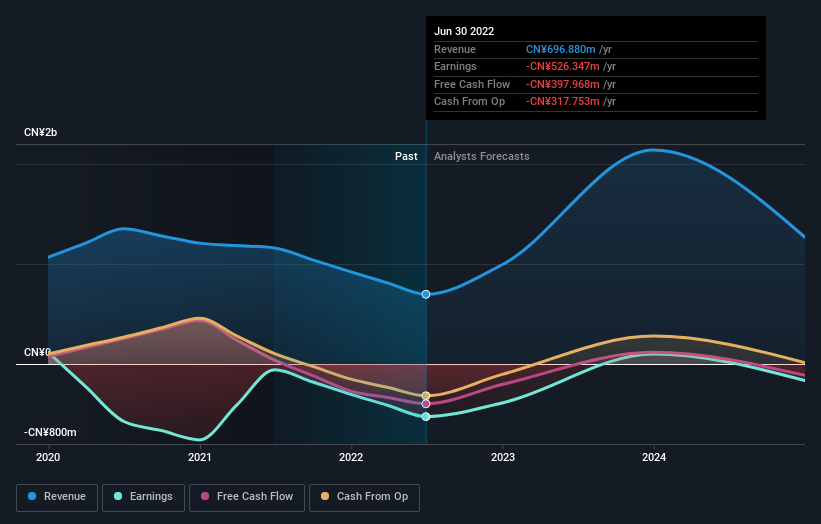

SEHK:9990 Earnings and Revenue Growth August 30th 2022

SEHK:9990 Earnings and Revenue Growth August 30th 2022Notably, the analysts have cut their price target 18% to CN¥4.98, suggesting concerns around Archosaur Games' valuation. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on Archosaur Games, with the most bullish analyst valuing it at CN¥7.86 and the most bearish at CN¥3.20 per share. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. For example, we noticed that Archosaur Games' rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 42% growth to the end of 2022 on an annualised basis. That is well above its historical decline of 40% a year over the past year. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue grow 22% per year. Not only are Archosaur Games' revenues expected to improve, it seems that the analysts are also expecting it to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their revenue estimates for this year. Analysts also expect revenues to grow faster than the wider market. Furthermore, there was a cut to the price target, suggesting that the latest news has led to more pessimism about the intrinsic value of the business. Given the stark change in sentiment, we'd understand if investors became more cautious on Archosaur Games after today.

Want to learn more? At least one of Archosaur Games' three analysts has provided estimates out to 2024, which can be seen for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.