While not a mind-blowing move, it is good to see that the Swancor Advanced Materials Co., Ltd. (SHSE:688585) share price has gained 16% in the last three months. But that doesn't change the fact that the returns over the last year have been less than pleasing. In fact the stock is down 19% in the last year, well below the market return.

If the past week is anything to go by, investor sentiment for Swancor Advanced Materials isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Swancor Advanced Materials

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unfortunately Swancor Advanced Materials reported an EPS drop of 26% for the last year. This fall in the EPS is significantly worse than the 19% the share price fall. So the market may not be too worried about the EPS figure, at the moment -- or it may have expected earnings to drop faster. With a P/E ratio of 76.89, it's fair to say the market sees an EPS rebound on the cards.

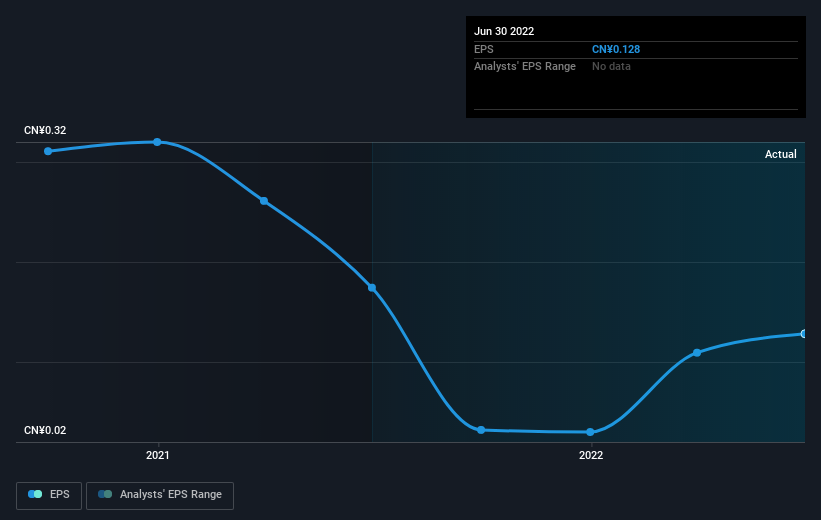

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

SHSE:688585 Earnings Per Share Growth August 29th 2022

SHSE:688585 Earnings Per Share Growth August 29th 2022Dive deeper into Swancor Advanced Materials' key metrics by checking this interactive graph of Swancor Advanced Materials's earnings, revenue and cash flow.

A Different Perspective

Swancor Advanced Materials shareholders are down 19% for the year, even worse than the market loss of 10%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. It's great to see a nice little 16% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. It's always interesting to track share price performance over the longer term. But to understand Swancor Advanced Materials better, we need to consider many other factors. Even so, be aware that Swancor Advanced Materials is showing 2 warning signs in our investment analysis , and 1 of those is a bit concerning...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CN exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.